les Nouvelles December 2015 Article of the Month

Maybe Patent Trolls Aren’t So Evil After All

Niro, Haller & Niro,

Senior Partner,

Chicago, Illinois, USA

I. Introduction

The long-awaited GAO (Government Accountability Office) Report on NPE litigation actually proves that all the noise coming from Silicon Valley about patent trolls is just that—noise. It is propaganda implementing a plan to run individual inventors out of business.

First, and most importantly, the GAO Report showed that NPEs are not responsible for the spike in patent litigation. Indeed, NPEs account for only 20 percent— that’s right, 20 percent—of all patent suits. So, if Congress fixes the so-called patent litigation problems by focusing on NPEs, it will fix only 20 percent of the problem.

Second, it is operating companies, not NPEs, that are running to the courthouse. Manufacturers (producers of actual patent-based products) bring most of the patent infringement cases and these cases have similar elements as those brought by patent licensing companies—massive expense and diversion of judicial resources.

Third, most patent litigation involves software-related patents—89 percent. With the decision in Alice Corporation Pty. Ltd. v. CLS Bank International, et al., 134 S.Ct. 2347 (2013) now on the books, that problem (if it really is one) will be quickly abated.

So what is the bottom line? The GAO Report proves that there is no patent litigation crisis caused by NPEs. And, if there are problems with the patent system, they are most likely caused by the quality, not owner, of the patent itself, whether that owner is an NPE or some other operating company.

II. The Special Interests Have Used Bogus Empirical Support

When special interest groups wanted tort reform, they got it by creating a mythical villain—the McDonald’s hot coffee case. The case of Liebeck v. McDonald’s was used to identify as a villain the personal injury lawyers who sought recoveries for a woman who spilled hot coffee on herself while sitting in the passenger seat of a parked car. A New Mexico jury awarded Stella Liebeck $160,000 in consequential damages to cover her medical expenses and $2.7 million in punitive damages to punish McDonald’s for its conduct. The trial judge reduced the punitive award to $640,000, but did not eliminate it. But, the tort reformers had finally found their villain and the $2.7 million punitive award became the focal point of a crusade to encourage tort reform nationwide.

Corporate-funded special interest groups, like Citizens Against Lawsuit Abuse, erected billboards reading: “Spill Hot Coffee, Win Millions: Play Lawsuit Lotto.” Lobbying groups spent astronomical sums to influence elections and legislation, all in the name of reigning in “frivolous suits” and “exorbitant windfalls” for plaintiffs. They even named an award for Ms. Liebeck—the “Stella Award,” given annually for the most frivolous case of the year.

The tactic worked. In a few years after Stella’s case, over 30 states had instituted caps on non-economic damages. The Supreme Court, in StateFarmv.Campbell,538 U.S. 408 (2003), overturned a punitive damages award, claiming that a 4-1 ratio of punitive to compensatory damages was much more constitutionally proper. Some would argue this was all a good thing. But, there are many who believe the tragic consequence of this effort was that consumers are now less protected, and corporations less concerned, about putting profits ahead of the well-being of the public. A punitive damages award, after all, was one way to deter bad behavior, whether in the form of medical malpractice or product liability.

And, of course, like all the patent troll talk today, the real hot coffee story got lost in the propaganda:

- Stella Liebeck suffered third-degree burns on 6 percent of her body and lesser burns on 16 percent of her body.

- She endured eight days in the hospital having multiple skin grafts.

- McDonald’s knew that a liquid at 190°F would cause third-degree burns in three seconds, yet brewed its coffee at 205°F, despite previous complaints and numerous injuries to its customers.

Shame on those who misused someone’s real injuries to justify their personal agendas. To them: the “end” obviously justified the “means.”

III. Patent Trolls

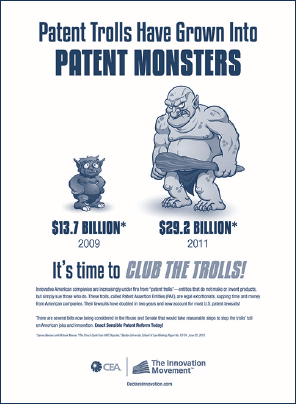

Despite the empirical evidence in the GAO Report, we now have posters like this on display at this year’s CES show in Las Vegas, “Club the Trolls”:

Despite the empirical evidence in the GAO Report, we now have posters like this on display at this year’s CES show in Las Vegas, “Club the Trolls”:

After the President’s State of the Union message in which he promised to rein-in abusive patent litigation practices so American businesses can remain focused on innovation (probably reading from a script written by Apple or Google), the Internet Association cheered the President, proclaiming that: “The days of patent trolls taking $80 billion a year out of our economy and terrorizing innovative and hard-working businesses are numbered.” IP Law360, “Obama Praised for Pushing Patent Reform,” Wickham, A., January 29, 2014. So there you have it: $80 billion a year (up from $20 billion), all caused by the villainous trolls—which, most unfortunately, include thousands of hard-working individual inventors (and their small companies) who lack the resources to take on giant infringers like Cisco, Apple, Intel, HTC, Google, Samsung, Microsoft and others. If the special interests get their way, individual inventors will soon be extinct, not to be heard from again.

IV. Who Is Driving The Anti-Troll Movement?

Likely tens, if not hundreds, of millions of dollars have been spent by Apple, Google, Intel, Cisco, Microsoft, Sony, Hewlett-Packard and other special interests to influence Congress, the President and the courts. Interestingly, the Apple-Google-Intel-Cisco-Microsoft group collectively was granted more than 10,000 United States patents last year, ranking fourth, eleventh, thirteenth, eighteenth, nineteenth and fortieth on the list of the top patentees. No individual inventor was even on the list.

Not to pick on IP Law360, but that publication has become a paid mouthpiece for these special interests. Case in point: on January 17, 2014, IP Law360 ran an article about a patent troll suit that it claimed was doomed to fail at the FTC. The authors repeatedly used the words “Patent Troll,” and then just as carefully captioned another article, “Nortel Patent Buyer Accused of Intimidation Tactics.” The Nortel Patent Buyers, of course, were gently called patent buyers, not trolls. Yet, the Rockstar Consortium that had purchased the Nortel patents (and also makes no products, like the evil trolls, sued manufacturers for patent infringement, but was only called a “buyer” of patents, not a troll. Could this possibly be because Rockstar is backed by Apple, Microsoft, Sony, BlackBerry (formerly, Research in Motion) and others pushing the anti-troll campaign?

What about Hewlett-Packard that formed a separate company that also makes no products but, instead, licenses and enforces patents it purchased? Or IBM, GE, Texas Instruments, Qualcomm and other giants who routinely license patents they do not practice for billions of dollars each year. Are they trolls or is it all a myth?

V. The Patent Troll Myth

Contrary to the propaganda about the evil patent trolls, the GAO Report shows this:

- For the period from 2007-2011, the GAO found that these [Patent Monetization Entities] PMEs brought only about one fifth of all patent lawsuits (19 percent), while operating companies (i.e., “companies who make products”) initiated about 68 percent of all patent suits. Suits brought by individual inventors accounted for about 8 percent of all patent suits, while research firms and universities accounted for less than 3 percent of all suits.

- Over this period, the GAO determined that a significant percentage of patent lawsuits were based on software patents. In particular, about 84 percent of PME patent lawsuits were based on software patents, while about 35 percent of operating company suits were based on software patents.

- From 2007—2011, about 32 percent of all patent lawsuits were filed in 3 of the 94 Federal District Courts: the Courts in the Eastern District of Texas, the District of Delaware and the Central District of California.

Near the end of the Report, the GAO made the following critical observations:

Public discussion surrounding patent infringement litigation often focuses on the increasing role of NPEs. However, our analysis indicates that regardless of the type of litigant, lawsuits involving software-related patents accounted for about 89 percent of the increase in defendants between 2007 and 2011, and most of the suits brought by PMEs involved software-related patents. This suggests that the focus on the identity of the litigant—rather than the type of patent—may be misplaced.… Examining the types of patents and issues in dispute represents a potentially valuable opportunity to improve the quality of issued patents and the patent examination process and to further strengthen the U.S. patent system.

(emphasis added).1

- Independently, it has been shown that NPEs are not the reason for the rise in patent suits. As the former head of the PTO, David Kappos, noted:

To the disappointment of IP alarmists, these fact- based studies conclude that patent assertion entities are not responsible for the recent uptick in patent litigation. The building is not on fire. And complaints over the sheer number of patent lawsuits cannot simply be chalked up to “too many trolls.”

IP Law360, “Facts Show Patent Trolls Not Behind Rise In Suits,” January 15, 2014, Kappos, David. - Likewise, as Jack Lu’s studies proved, patent licensing and damage awards for NPEs are not excessive, again, according to the only analytical study done on the subject:

This paper offers the first empirical study on royalties paid to NPE licensors. Using royalty rate data from RoyaltySource and ktMINE, this study concludes that royalty rates obtained by NPEs are not different from those paid to practicing company licensors. This finding contradicts the argument that NPEs are systematically overcompensated, at least based on evidence from the license market. The conclusion holds true across various model specifications, with or without controlling for the effects of major factors such as exclusivity, industries, and upfront payments or other auxiliary payments.

“The Myth and Facts of Patent Troll and Excessive Payment: Have Nonpracticing Entities (NPEs) Been Overcompensated?” Business Economics, Vol. 47, No. 4, Jiaqing (“Jack”) Lu, p. 235.

In short, no factual evidence and certainly no analytical data supports the argument that NPEs allegedly cost the economy $80 billion a year. It is pure propaganda. The GAO Report proves that fact.

VI. What Are The Consequences Of The Bogus Anti-Troll Campaign?

The eBay case gutted the patent property right for individual inventors and their non-manufacturing companies by making injunctive relief nearly impossible for an NPE. Without the right to exclude, the patent right is far less valuable. Why? Because the right to exclude is the essence of property. How would you feel if a private party could force you to sell your house or favorite watch at a whim? Property, at its core, is the right to exclude, which is the very essence of a patent right. Without it, the playing field can never be leveled.

Who fears a compulsory license? Certainly not a corporate giant who can protract a lawsuit by as many as 4 to 6 years and afford to pay $5 to $10 million in legal fees. Apple, for example, has around $150 billion in cash. Invested at 5 percent, that yields $7.5 billion a year in interest or a little over $20 million a day. Do you think Apple really worries about a patent infringement suit brought by a so-called patent troll (even 20 cases a year)? Apple could pay its lawyers $10 million per case which represents 10 days of interest. One case is a half-day’s interest.

By eliminating the threat of an injunction, infringers achieve a “heads, I win; tails, you lose” situation. As former Federal Circuit Chief Judge Howard Markey observed years ago, that approach is unfair because infringers should not be treated like willing licensees: A[an] infringer would have nothing to lose, and everything to gain if he could count on paying [after trial] only the normal, routine royalty non-infringers might have paid.” Panduit Corp. v. Stahlin Bros. Fibre Works, 575 F.2d 1152, 1158 (6th Cir. 1978) (opinion written by former Chief Judge Markey of the Federal Circuit). By eliminating injunctive relief (or making it nearly impossible to obtain), a mandatory license, in effect, is being dictated. And the little guy, no matter how it gets sugar-coated, suffers.

Also forgotten in the debate about “patent trolls” is the important role played by trial judges. Injunctions are discretionary, not mandatory. So, too, are increased damage awards after a jury’s finding of willfulness. If there is something amiss, the trial judge can fix it by granting JMOL, denying an injunction or refusing to increase damages.

Worse, what is now left of patent suits brought by individual inventors, namely damage awards, has been undermined by a series of Federal Circuit (and Supreme Court) decisions—Unilock USA v. Microsoft Corp., 632 F.3d 1292 (Fed. Cir. 2011) (setting aside the 25 percent rule as a starting point for a reasonable royalty); Laser Dynamics, Inc. v. Quanta Computer, Inc., 694 F.3d 51 (Fed. Cir. 2012) (making it impossible to reference an infringer’s sales volumes and requiring that only the smallest saleable patent-practicing unit be used to determine a proper royalty base) and most recently the VirnetX appeal where the Federal Circuit took away a $368 million damage award against Apple on the notion that the patentee had to figure out the value of Face-Time components in an Apple iPhone, e.g., front facing cameras, a portion of a microprocessor, etc.

The so-called “smallest saleable unit” rule should be re-named, the “smallest possible damage rule” unless, of course, you are Apple suing Samsung.

Finally, Daubert v. Merrell Dow Pharms., Inc., 509

U.S. 579 (1993) (which wipes out most damages experts before they even begin to testify) seals the deal. The cumulative impact of all of this is that, even if an NPE wins before a jury (which is becoming less and less likely), the Federal Circuit will take any significant damage award away.

As for willfulness, forget it. The case of In re Seagate Technology, LLC, 497 F.3d 1360 (Fed. Cir. 2007), put that to rest six years ago. See also, Bard Peripheral Vascular, Inc. v. W.L. Gore & Assocs., 670 F.3d 1171 (Fed. Cir. 2012) (“the objective determination of recklessness

… is best decided by the [district] judge subject to de novo review”); Spine Solutions, Inc. v. Medtronic Sofamor Danek USA, Inc., 620 F.3d 1305 (Fed. Cir. 2010) (defendant is not objectively reckless if it relies on a “reasonable” defense). So, there now is really no chance for increased damages in a patent case brought against a giant infringer. All the giant need do is get a legal opinion saying the accused patent is either invalid or not infringed.

Maybe the Supreme Court will fix at least the willfulness dilemma by noting that the words “willful infringement” don’t even appear in § 284 and that district judges should have discretion under § 284 to increase damages, just as they do to award fees under § 285. I call this “discretionary enhancement.”

So what is left? A world in which infringers have little or no risk and, with superior economic power, can simply “grind out” most individual inventors. Wes Whitmyer (a noted patent attorney) summed up the situation this way—the deck is stacked:

Much of the post-war U.S. economic success has been based on innovation secured by strong protection for intellectual property rights. Innovation alone is not enough. Innovation without protection just encourages copying. Copyists with lower manufacturing cost will destroy the market for any innovative product not protected by strong intellectual property laws. Innovation drives growth, but only when it benefits from strong intellectual property protection. A 2012 U.S. Commerce Department report (see http://www.esa.doc.gov/Reports/intellectual-property-and-us-economy-industries-focus) concluded that 40 million jobs, or 28 percent of the U.S. workforce depends heavily on intellectual property. Nearly 35 percent of U.S. GDP comes from IP-intensive industries. Killing patents risks destroying our economic engine and puts our future prosperity at risk.

…Why should copyists halt unlawful activity if the only penalty is possible payment of a small percentage royalty? Even more troubling is that the bigger a company is the more incentive it has to infringe—so long as it earns more money infringing than it spends to defend the unlawful activity, there is no economic incentive to stop. …

I agree with Wes. In the risk-versus-reward analysis that drives most corporate decisions, the risk now is so minimal that it makes more sense to litigate, not settle.

VII. The Legislative Onslaught

Despite the GAO Report they requested, the same people that create a mess of nearly everything they touch are now attacking invention at every turn. I sometimes ask myself if our Congress is still working for the American people. In 2013, no less than 10 attempts were made to destroy what’s left of individual invention in America:

The Saving High-Tech Innovators from Egregious Legal Disputes (SHIELD) Act

The Saving High-Tech Innovators from Egregious Legal Disputes (SHIELD) Act (H.R. 845) was introduced in the House of Representatives on Feb. 26, 2013, and is not currently being considered by the House Judiciary Committee in light of the recently passed Innovation Act. The bill attempted to put more risk on an NPE by requiring the NPE to post a bond to cover a defendant’s legal fees and costs in defending the case.

The Patent Quality Improvement Act

The Patent Quality Improvement Act (S.866) was introduced in the Senate on May 5, 2013, and is currently referred to the Committee on the Judiciary. This bill would maintain the covered business method review program and expand it to all industries instead of just the financial industry.

The End Anonymous Patents Act

The End Anonymous Patents Act (H.R. 2024) was introduced in the House of Representatives on May 15, 2013, and is not currently being considered by the House Judiciary Committee in light of the recently passed Innovation Act. The bill addressed transparency by requiring an NPE to identify the real parties in interest.

The Patent Abuse Reduction Act

The Patent Abuse Reduction Act (S.1013) was introduced in the Senate on May 21, 2013, and is currently referred to the Committee on the Judiciary. The bill heightens the pleading requirements for claims of patent infringement requiring the plaintiff to identify the patent claims being asserted, details of the asserted infringement, the principal business of the plaintiff, and the real parties in interest.

This bill also attempts to decrease the lopsided discovery burdens in NPE litigation by having the producing party pay for “core documentary evidence” but shifting the cost to produce additional discovery to the requesting party. Moreover, the bill stays most discovery efforts until after claim construction. Finally, the bill further puts an NPE plaintiff at risk by including a cost and fee-shifting provision, unless the loser’s positions were “objectively reasonable and substantially justified.”

The Patent Litigation and Innovation Act

The Patent Litigation and Innovation Act (H.R. 2639) was introduced in the House of Representatives on July 9, 2013, and is not being currently considered by the House Judiciary Committee in light of the recently passed Innovation Act. The bill has similar language to the Senate’s Patent Abuse Reduction Act with respect to pleading standards and discovery provisions. Additionally, the bill allows suits between an NPE and an end-user to be stayed pending resolution of a suit between the NPE and the manufacturer. Finally, the bill provides a court with greater latitude in issuing sanctions for frivolous filings.

The Stopping the Offensive Use of Patents (STOP) Act

The Stopping the Offensive Use of Patents (STOP) Act (H.R. 2766) was introduced in the House of Representatives on July 21, 2013, and is currently referred to the Subcommittee on Courts, Intellectual Property and the Internet. This bill is similar to the Senate’s Patent Quality Improvement Act with respect to expanding the covered business method review program.

The Innovation Act

The Innovation Act (H.R. 3309) was introduced in the House of Representatives on Oct. 22, 2013, and passed on Dec. 5, 2013, by a 325-91 vote. This bill addresses almost every area of reform raised in the previous bills. For example, bill adopts similar language to the Senate’s Patent Abuse Reduction Act and the House’s Patent Litigation and Innovation Act with respect to pleading standards, discovery costs, delaying discovery until after claim construction, and cost and fee shifting.

As with the Patent Litigation and Innovation Act, the bill allows suits between an NPE and an end-user to be stayed pending resolution of a suit between the NPE and the manufacturer. The Innovation Act originally maintained the current scope of the covered business method review program, but that provision was recently removed by amendment.

The Patent Litigation Integrity Act

The Patent Litigation Integrity Act (S. 1612) was introduced in the Senate on Oct. 29, 2013, and is currently referred to the Committee on the Judiciary. The bill has a fee and cost-shifting provision similar to the Patent Abuse and Reduction Act but like the House’s SHIELD Act, it requires a patent owner to post a bond against the fees.

The Patent Transparency and Improvements Act

The Patent Transparency and Improvements Act (S. 1720) was introduced in the Senate on Nov. 17, 2013, and is currently referred to the Committee on the Judiciary. This bill provides end-user protection by a manufacturer similar to the House’s Innovation Act, has various transparency provisions similar to the Innovation Act and has a provision allowing the Federal Trade Commission to take action against demand letters sent in bad faith.

The Demand Letter Transparency Act

Finally, the Demand Letter Transparency Act (H.R. 3540) was introduced in the House of Representatives on Nov. 18, 2013, and is currently referred to both the Committee on the Judiciary and the Committee on Energy and Commerce. This bill requires demand letters sent on behalf of NPEs to over 20 companies to have certain minimum content requirements and be maintained in a national database.

See, IP Law360, “10 Ways Congress Tried to Address NPE Litigation In 2013,” Keener, J.J., January 2, 2014.

In Oregon, Nebraska, Vermont, Illinois, and other states, legislatures are considering or have already passed bills to criminalize the sending of notice letters to accused infringers—something federal law requires as a prerequisite to an award of damages. In Chicago, we even have an alderwoman more worried about patent trolls than pot-holes so deep that one critic recently said, “Only the drunk, they say, drive in a straight line in Chicago.” Highways to Hell, The Economist, April 19, 2014.

VIII. The Executive Branch Weighs In: Let’s Kick Them When They’re Down

Google managed to move its former patent counsel to the role of Deputy Commissioner of Patents then defeat a really talented potential PTO leader like Phil Johnson on the theory he was too soft on patent trolls. Promptly after Google’s appointee met with special interest groups in a secret, closed-door meeting, she announced that she was in favor of supporting innovation through legislation aimed at individual inventors:

…Going forward, the USPTO will continue to actively engage with our stakeholders, members of Congress from both political parties, as well as with others in the administration, to further improve our patent and patent litigation systems. That includes supporting Congress’ current consideration of legislation to target abusive patent litigation tactics and speed resolution of disputes over IP rights.

http://patentlyo.com/patent/2014/01/administration-prosecution/litigation. html, Crouch, D.

No surprise there. Now we have one side of the USPTO that grants patents and another that takes them away.

IX. The Thirst For Attorneys’ Fees

One additional way to run the little guy into the ground is to threaten an award of legal fees at every turn. Of course, the notion that courts (not legislatures) can best curb abusive practices is fair enough. That makes sense. But, Arthur Miller, who co-wrote the book on Federal Civil Procedure, made this point in a 2013 NYU Law Review article:

Bogus caseload statistics are propagated, while empirical data is ignored, and fears are spread by claims that there is a litigation explosion in this country and that Americans are paying a litigation tax that renders our businesses uncompetitive.

(p. 302). Professor Miller then correctly concluded that his research showed that many advocates believe that a frivolous case is “any case brought against your client” and that litigation abuse was “anything the opposing lawyer is doing.” 88 NYU Law Rev. 361.

Now, nearly every case that is decided against a patentee results in a claim that the case was frivolous and a motion to find the case exceptional under 35 U.S.C. § 285 or subject to sanctions against the opposing lawyer and law firms under 28 U.S.C. § 1927 or the court’s inherent power.

Soon, all the law firms who represent individual inventors and their companies may be forced out of business. That is what the special interest groups want. And they won’t stop until they get it.

X. Goodbye Mr. Inventor

It is a given that the pendulum has decidedly swung against the individual inventor in favor of larger companies who have the resources to file multiple patent applications on an idea or wage the expensive IPR post- grant war. Meredith Addy notes in a recent article she wrote that:

There’s a trend here. When the America Invents Act changed “first-to-invent” to “first-to-file,” it favored larger companies with a larger investment in R&D, a larger war-chest of inventions in their pipeline, a cadre of sophisticated IP counsel in-house and/or on retainer who could prosecute and protect the patents, and the financial wherewithal to battle any pretenders to their patent crown. “First-to-file” was a potentially debilitating move for smaller and entrepreneurial companies, and it was promoted and defended by large technology companies.

The presence in our marketplace of companies that can assert patents on behalf of smaller inventors is not a bad thing in principle—or in practice. As I’ve said before, let’s not throw the innovative baby out with the larger tub of muddied water. …

http://www.steptoefederalcircuitbusiness.com/2014/02/the-thirty-nine-steps.

Consider the names of individual inventors who ultimately formed companies to exploit their ideas but initially manufactured nothing: Westinghouse (air brake), Ford (car), Gillette (razor), Hewlett-Packard (oscillation generator), Otis (elevator), Harley (motorcycle shock absorber), Colt (revolving gun), Goodrich (tires), Goodyear (synthetic rubber), Carrier (air treatment), Noyce (Intel), Carlson (Xerox), Eastman (laser printer camera), Land (Polaroid), Shockley (semiconductor), Kellogg (grain harvester), DuPont (gun powder), Nobel (explosives), the Wright Brothers (aircraft), Owens (glass), Steinway (pianos), Bessemer (steel), Jacuzzi (hot tub), Smith & Wesson (firearm), Burroughs (calculator), Carothers (nylon), Curtiss (aircraft), Houdry (catalytic cracker), Marconi (wireless communication), Goddard (rocket), Diesel (internal combustion engine), Fermi (neutronic reactor), Disney (animation), Sperry (Gyro scope), Williams (helicopter) and even Abraham Lincoln who was granted U.S. Patent No. 6,469. These are individuals who, in most cases, worked alone, without government or corporate support, yet, created not just new inventions, but whole new industries that employ millions of people today.

It can be argued, of course, that ultimately some of these inventors became manufacturing companies and that companies that merely buy patents from individual inventors contribute nothing. But what about small companies that are struggling to compete against corporate giants and need a strong patent system to level the playing field? As the inventor of the MRI scanning machine, Dr. Raymond Damadian, observed, it’s the small companies that often provide the economic spark for new jobs:

Few Americans realize that the great majority of new jobs created for the public are provided by small companies with fewer than 500 employees. From 1981 to 1988, companies with fewer than 500 employees contributed 11.7 million new jobs to the economy. In this period, America’s small companies generated two thirds of all new employment.

Patents Legislation: Hearings Before the Subcommittee On Courts and Intellectual Property of the Committee On the Judiciary, House of Representatives, 104th Congress, First Session, On H.R. 359, p. 128. What portion of the Constitution or the patent law reserves the right to obtain and enforce patents exclusively for large manufacturing companies? And how can an individual or small company compete against a large company that decides to copy and face the risk of litigation?

So, maybe it’s time to say goodbye to the individual inventor and let the patent system belong exclusively to big business. That is the reality of where we are heading.

- “GAO Report Fails To Make It “Open Season” On Trolls,” by Thomas J. Bean, Ralph A. Dengler and Todd M. Nosher, September 4, 2013.