les Nouvelles March 2018 Article of the Month

Licensing In Cosmetics: A Practical Approach

L’Oréal Research & Innovation

Senior Licensing & Business Development Manager

Clichy, France

The worldwide cosmetic market is estimated around 18figure0 billion € (sell-in price) and is dominated by historical, large international corporations (L’Oréal, Unilever, Coty, Procter & Gamble, Shiseido, Johnson & Johnson, Estee Lauder). However, despite a global, steady growth of about three percent per year, this market covers many diverse regional and local situations. Indeed, the rising of the middle-class category in the developing countries is leading to new consumer expectations and demands, as well as to the emergence of new players. Among the latter, many have gained sizeable market positions for certain categories of products or in specific channels of distribution. Furthermore, new consumer behaviors such as e-business, web-blog publishing, product personalization and digitalization or sustainable consumption have led to a fast changing market for which the cosmetic brands need to quickly adapt, yet keeping their genuine and historical roots.

Although beauty is a universal value, ancestral and cultural habits have modeled beauty to infinite routines across the world. To offer cosmetic products to women and men worldwide, there is a need to fully integrate this extraordinary diversity of habits and trends, while proposing products meeting the highest standards of quality and sustainable development. This is what is called by L’Oréal “Universalization,”( i.e. how to develop innovative technology-based products and adapt them to the local needs.) '

Considering both the market speed of change and the “Universalization” strategy, the search for product innovation is a key driver for success. Open innovation represents a huge opportunity to fulfill consumer unmet needs and all kinds of partnerships and alliances have emerged in the field of cosmetics.

The present paper highlights the main features of a license in cosmetics and proposes a possible approach to structure it. It shows how licensing can facilitate open innovation transactions in the field of cosmetics, for which very little data about licensing have been published so far. Only the in-licensing perspective will be illustrated in this study.

Cosmetics: A Huge Variety of Products

What is common between a shampoo, a lipstick, a perfume and a topical cream against itchy skin? They all contribute to the beauty, wellness and self-reassurance of their user; however, from a strict technology point of view, these products have very little in common. Each cosmetic product is a combination of different active materials embedded in a formulation aimed at facilitating their application, as well as providing an immediate wellness sensation. Moreover, the product texture frequently results from a sophisticated manufacturing process and needs a suitable, well-designed packaging. The recent years have also seen the emergence of energy-based cosmetics making use of devices, such as the rotating brush for skin deep-cleansing, light-emitting instruments or the steam flat iron for hair styling. Last but not least, the cosmetic product is a strictly regulated product which must comply with international regulations on ingredient quality, stability and traceability. Overall, a cosmetic product is the sum of many technologies which all contribute to the final performance and client satisfaction.

Another characteristic of the cosmetic product is the large range of scales at which it can be produced. The L’Oréal group facilities manufacture more than six billion units per year, representing a huge variety of references. Therefore, large discrepancies exist between products. Each product reference for the mass market may be produced well-above several million units per year. Conversely, niche or highly-selective products as well as products for local markets may be manufactured in the range of thousands. Volumes may also greatly vary from year to year to adapt to the market situation and the consumer needs; some products have a short market life whereas others have been on the markets for a decade or more.

All these features make the cosmetic product a kind of hybrid between a fast moving consumer good (FMCG) and a health product.

The In-Licensing Perspective

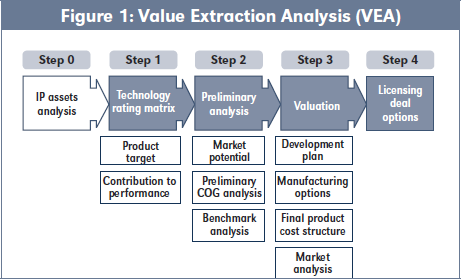

From an in-licensing perspective, any profit-split analysis has to cope with the product profitability. As widely accepted, the profit-split analysis consists in allocating the profit of the business to the different assets that contribute to it, which is an uneasy task. Furthermore, regarding the cosmetics area, the high variety of products, the diversity of markets, the packing of technologies in a single product and the highly-variable manufacturing forecast clearly represent a true challenge to establish the relative and absolute values of each asset. Indeed, when considering a technology to be licensed in cosmetics, the  licensing manager is rarely able to embrace its full potential and readily assess its impact on the innovation pipeline of the company. Very often, many products may benefit from the licensed technology. In order to extract the maximum value from the licensed material it is crucial to set up the possible, yet realistic opportunities it can bring. Unlike the pharmaceutical field where the commercial target for a licensed chemical entity is usually well-known, the situation in the cosmetic field could be much less defined. A film forming polymer could very well be incorporated into a lipstick as well as in a hair care product, both opportunities leading to two different commercial realities. Therefore, a stepwise approach associated to a continuous assessment of the licensing opportunity potential is strongly advisable. This is what is called the Value Extraction Analysis (VEA): See Figure 1.

licensing manager is rarely able to embrace its full potential and readily assess its impact on the innovation pipeline of the company. Very often, many products may benefit from the licensed technology. In order to extract the maximum value from the licensed material it is crucial to set up the possible, yet realistic opportunities it can bring. Unlike the pharmaceutical field where the commercial target for a licensed chemical entity is usually well-known, the situation in the cosmetic field could be much less defined. A film forming polymer could very well be incorporated into a lipstick as well as in a hair care product, both opportunities leading to two different commercial realities. Therefore, a stepwise approach associated to a continuous assessment of the licensing opportunity potential is strongly advisable. This is what is called the Value Extraction Analysis (VEA): See Figure 1.

Step 0: IP assets analysis

The analysis of the quality of the IP assets involved in the transaction is based on standard, commonly-used procedures. Therefore, this step will not be detailed in the present paper. Simply, the analysis will focus on the quality of the exclusivity (i.e. scope of the patentable claims, patent status and remaining enforcement time, geographical coverage, infringement detection) as well as on the global patent environment. Obviously, a good IP asset rating is a pre-requisite to move the process forward.

Step 1: The technology rating matrix

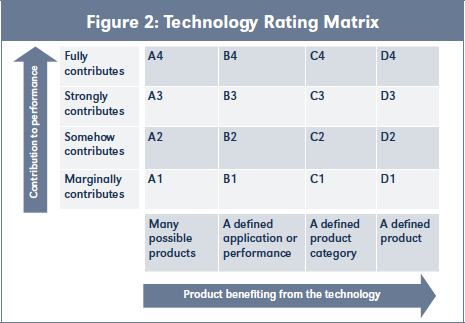

First, to initiate the VEA, two basic questions must be addressed prior to any financial value assessment: Which product will benefit from the licensed technology? To which extent the patented technology will contribute to the product performance? It might be rather difficult to answer both questions, especially when the Technology Readiness Level (TRL) is low.1

Performance should be understood in its broad sense, i.e. all the key drivers making the product successful. It might be translated into, for example, the technical performance, the consumer benefit, the product uniqueness, a cheaper production process, a favorable impact on sustainability or any similar feature.

The following matrix may facilitate the technology rating, according to the criteria of the contribution to performance and the product definition:

For example, a screening test method will only marginally contribute to the performance of the final, commercialized product, whereas it potentially could be applied to a very large range of products (box A1). On the other side of the spectrum, one can find a ready-to-launch technology for the treatment of dry skin which will fully contribute to the performance of a specific product (box D4).

For example, a screening test method will only marginally contribute to the performance of the final, commercialized product, whereas it potentially could be applied to a very large range of products (box A1). On the other side of the spectrum, one can find a ready-to-launch technology for the treatment of dry skin which will fully contribute to the performance of a specific product (box D4).

Such a matrix helps to define how the licensing-in opportunity will contribute to the innovation pipeline of the company. For example, in the case D1 (the technology marginally contributes to a very specific product), one should ask himself whether it is worth to enter into a licensing deal. The output of the rating matrix may therefore be a “No go.” Conversely, the case A4 certainly represents an opportunity that cannot be missed. Obviously, such positions will also take into account the development level of the technology (the TRL).

Therefore, taking into consideration the competing technologies and the alternative opportunities, the rating matrix will ease discriminating between “Must Have” and “Nice to Have” technologies.

Furthermore, as development and TRL progress, the matrix may evolve with time. Indeed, development teams may focus their effort on a narrower product category or technology contribution may be revisited thanks to a deeper evaluation.

It is important to share this matrix with the licensor and explain how the licensed technology will be assessed accordingly. This will define the scope of the assets involved in the deal and subsequently, their valuation. Although it may be one of the most difficult tasks to achieve, a common understanding of the technology rating at an early stage of the process, is key to pave the way to a successful licensing deal.

Step 2: The preliminary analysis

The second step of the VEA relates to the business environment into which the technology will be embedded. The aim of the preliminary analysis is to establish whether the technology and the associated IP will induce a probable profitability for the licensee. To this end, based on the technology rating matrix, three facets are investigated:

- . A preliminary market analysis, based on the target products identified in Step 1.

- A preliminary cost of goods analysis of the products in which the technology will be embedded. Depending on the maturity level of the technology (i.e. how far the technology from implementation by the licensee is), such an analysis may be somehow hypothetical. However, finding out the contour of the cost structure will indicate whether the licensing project is viable.

- Identifying a relevant benchmark which will be used as the market reference to establish the profitability robustness of the licensed material. The benchmark will favorably be an internal one, supporting no licensing fees and for which the full cost structure and profitability roots are understood. Alternatively, it could be an external reference, such as a competitor’s product. In that case, care must be taken to ensure that the benchmark is relevant and useful.

Of course, Step 2 can include several hypothesis, such as different channels of distribution (e.g. mass market and selective) or different routes of commercialization (e.g. local market than worldwide). At the end of Step 2, the viability of the licensing approach has to be established. Should the maturity level of the opportunity be sufficient (TRL ≥ 7) and the launch plan finalized, Step 2 may be skipped and Step 3 analysis done readily.

Step 3: The licensed technology valuation

At this stage, additional information needs to be included in the licensing model. This information includes both internal data as well as data generated by or with the licensor:

- A finalized development plan including all the elements impacting the product cost and nature, such as the regulatory constraints and pathway according to the territories of commercialization, the full evaluation plan, the scope of the product claims, the packaging options, if applicable. It must be noted that the regulatory strategy is a key component in the valuation. Indeed, regulations strongly restrict the possibility for a product to exist under different regulatory status (e.g. pharmaceutical and cosmetic), which might lead to an exclusive deal and forbid the use of the technology under another regulatory pathway.

- The industrial options: the manufacturer of the licensed material and of the licensed material-containing product (will it be the licensor, the licensee or a third party?), any manufacturing investment, the international manufacturing strategy, including a description of the supply chain.

- The product cost structure must be defined as precisely as possible. At this stage, the impact of the licensed material cost of goods on the final commercialized product cost must be perfectly understood.

- A comprehensive market analysis featuring the possible options of commercialization, including territories and channels of distribution.

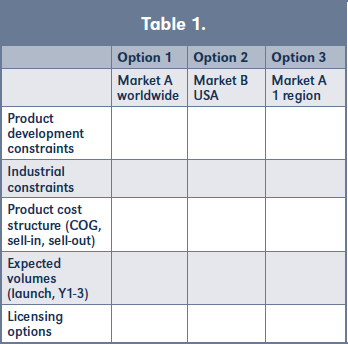

At the end of Step 3, the total value extracted from the licensed material is fully characterized. According to the possible options of commercialization, available data can be displayed in a Table 1.

At the end of Step 3, the total value extracted from the licensed material is fully characterized. According to the possible options of commercialization, available data can be displayed in a Table 1.

Obviously, a time dimension can be incorporated into the chart. Hypothesis on the speed of market penetration over time (i.e. the rate of success) can be further implemented.

Step 4: Licensing deal options

Once the analysis is finalized, the licensing options can be prepared.

As previously mentioned, the relationship between IP asset valuation and business profitability is far from obvious. The analysis described above both at the “micro” level (i.e. the product definition and cost structure) and at the “macro” level (i.e. the market opportunity over competition), helps finding out the key drivers for product profitability within a specific business environment/market.

Basically, two different, non-exclusive approaches can be taken to value the licensed technology and the related IP assets: (1) a metered price, i.e. a running royalty based on net sales and (2) a lump-sum price, i.e. a fixed fee. As underlined by D. Kidder et al. (les Nouvelles, L (4) 217-220, (2015), there is no straightforward relationship between both, although a conceptual link exists.

The initial approach is to look at whether a licensing fee on net sales can be applied to the licensed product to maintain at least the same profitability as the benchmark product. The maximum licensing fee can be calculated according to:

MLF=100 (MPB SIPL-MPL SIPB) SIPB SIPL

Where:

-MLF: maximum licensing fee (% of sell-in price)

-MPB: manufacturing price of the benchmark product

-MPL: manufacturing price of the licensed product (or licensed material-containing product)

-SIPB: sell-in price of the benchmark product

-SIPL: expected sell-in price of the licensed product (or licensed material-containing product)

If SIPL is unknown, one can simply consider SIPL = SIPB and find:

MLF=100 (MPB-MPL)/SIPB

As a matter of fact, if MPL ≥ MPB, then MLF=0

Therefore, SIPL should be adjusted according to MLF and MPL, such as:

SIPL=(SIPB LF + MPL)/MPB

Where LF is the licensing fee per product.

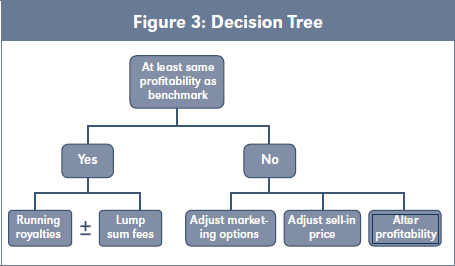

Once this computation is finalized, a decision tree can be drafted, Figure 3:

Once this computation is finalized, a decision tree can be drafted, Figure 3:

In the case where similar profitability cannot be achieved, several options can be taken:

- Alter the profitability to a lower level

- Adjust the sell-in price to accommodate a similar profitability. Depending on the technology rating matrix, the market may stand a premium price to reflect technology uniqueness and higher performance

- Adjust the marketing options, for example starting with a limited launch or restricting the commercialization through selective brands only

In any of these options, the VEA may be conducted again in order to compute a suitable licensing fee.

In the case where at least a similar profitability is obtained, the licensing fee can be structured as running royalties on net sales or lump sums or both. Alternatively, when applicable, the corresponding IP assets may also be purchased.

The most common approach that is used in the cosmetic sector remains the lump sum structure. Indeed, the high product turn-over associated to the multi-featured and evolving nature of the products make the lump sum approach the most suitable one for cosmetics.

Perspectives

As the cosmetic field is quickly evolving, new challenges related to open innovation appear, hence modifying the licensing practices in the field. One of the most striking examples is the emergence of the digital connected systems. The licensing managers in the cosmetic field need to learn about the approaches taken in the Information Technology (IT) sector. They must explore new ways of rating and extracting value from the connected technologies. Furthermore, they may face tough challenges regarding new IP-related issues, such as data property, multiple IP assets in the cloud or artificial intelligence-related IP.

Another exciting, yet challenging area is the licensing in the sustainable development sector. Although this area has been explored for several years,2 its emergence in the cosmetic field is rather new and the recent initiatives to limit global warming have increased the need to push forward the technology transfer of green technologies. Licensing can foster their diffusion across the world, providing a suitable approach is taken. Indeed, IP protection and valuation of environmental technologies require a specific knowledge and strategy. Know-how valuation (of a green production process for example) and profit sharing with communities will be crucial to conduct a successful licensing policy in the sustainable development field.

In Conclusion

The fundamentals of licensing in cosmetics are based on the multi-features aspects of the cosmetic product, as well as the fast-moving nature of the cosmetic market. Conducting a stepwise Value Extraction Analysis of the technology to be licensed will allow one to precisely define the features covered by the technology within the cosmetic product and to establish its relative value within a specific market and business environment. Sharing all or part of the VEA between the licensee and the licensor may help achieve a balanced and successful licensing deal. However, emerging trends such as the digital product transformation or the green technology dissemination will require adapting the licensing models to these new challenges. ■ Available at Social Science Research Network (SSRN): https://ssrn.com/abstract=2857181

- The Technology Readiness Level is aimed to map the progression of the technology from basic properties (TRL1) to actual applications and reported use (TRL9).

- For a more comprehensive review on licensing and sustainable development, please see Sustainable Development: A “Win-Win” for Licensing and for the Environment by William O. Hennessey, Franklin Pierce Law Center, 1996.