les Nouvelles May 2019 Article of the Month

Blockchain And Intellectual Property

Ocean Tomo

Analyst

Chicago, IL, USA

Ocean Tomo

Managing Director

Chicago, IL, USA

Undeniably one of the most anticipated and potentially revolutionary technologies since the invention of the internet, blockchain promises to usher in a new era of how we do business and handle information

Although a cryptographically secured chain of digital files was described in work* dated as early as 1991, the invention of blockchain in its current, most popular, form as a distributed ledger for transactions on a network, is credited to the pseudonymous Satoshi Nakamoto, the inventor(s) of Bitcoin, in 2008. Cryptography has been around for centuries, but the cryptocurrency and blockchain community as a whole largely considers Satoshi Nakamoto’s Bitcoin as the first blockchain

Although initially intended as the supporting technology behind a digital form of money, blockchain is beginning to show its potential to expand to numerous applications with real world use-cases in preexisting industries

Blockchain: The Technology

The blockchain is a distributed, shared, encrypted database that serves as an irreversible and incorruptible public repository of information. Put simply, it is a way to structure and store data, securely. The benefit of blockchain databases over traditional methods of storing data is the ability to track information over time, whereas a typical database is a snapshot of the information at a particular moment. With this expanded information set, a blockchain database can track the history of itself at any given point in time, a feature that opens information storage to a breadth of new use-cases and opportunities. The data exists in groups called “blocks” which appear in the blockchain in sequential order, and are formed by miners which are essentially graphical processing units (GPUs) dedicated solely to adding blocks to the blockchain. Each block is a record of data, such as cryptocurrency transactions, information, licenses, and countless other possibilities. Once each block of data is completed, it is added to the chain and the next block of data begins to form. As new blocks are formed from numerous, verified transactions, they are given a digital ID in the form of a number, known as a hash value. This hash value is used in conjunction with an input from the previous block, as well as a timestamp, ensuring that this block, its predecessor, and any future blocks will be linked in the correct order. Finally, the miner takes this combined “header” and begins to solve an equation using an arbitrary number called the nonce. This equation, also called a cryptographic hash function, is a mathematical algorithm for turning any set of data into a random hash number. In the Bitcoin blockchain, only blocks with hashes below a target value are accepted by the network. If a block of verified transactions is completed, yet the hash value return is above the target value, a new hash value must be computed. Fortunately, the miner need not verify a whole new set of transactions. In a cryptographic hash function, if the data inputs are even slightly different, they will produce completely different hashes and because of this, the miner can simply change the nonce to return a brand new, random hash. Miners are capable of testing billions of different hashes against the target value per second. Once a hash from a set of verified transactions is under the target value, it is sent out to and accepted by the network and miners repeat the process over again for the next block

Applications of the Blockchain

Far and away the most common use of blockchain technology at this point in time is cryptocurrencies. Cryptocurrencies are simply a digital asset used for the purchase and sale of goods, as a store of value, or for some other utility/unique benefit, much like any traditional fiat currency or gold. However, with the recent and significant rise in popularity of blockchain technology, many other use-cases and applications of the blockchain have been emerging

Companies involved in payment processing, decentralized third-party storage, and supply chain tracking and logistics are already integrating blockchain into their businesses, and sectors from healthcare to real estate to politics are already planning for blockchain implementation.

Patent Landscape in the Blockchain

Technology Space

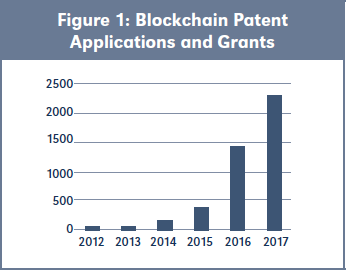

As a relatively new technology segment blockchain patent activity, while growing rapidly, is still fairly modest, with a total of 5,668 related, active patent filings (grants and applications) worldwide as of October 2018. Most firms holding blockchain-related patents are in the banking, finance, and tech industries, although this will likely change with the expected adoption of blockchain by many other industrial sectors. The number of blockchain-related patents has been growing dramatically, and patent applications have increased by over 50x from 2012 to 2017. According to Thomson Reuters’ Practical Law editor, Alex Batteson, “companies are moving fast in order to protect their ideas in new areas of technological development— long before the technology actually goes to market.” This allows companies to attract investment through their potential to capitalize on intellectual property, as well as the right to exclude other emerging competitors from the market going forward. The radical increase in blockchain patent applications and grants is shown in Figure 1

The growing number of applications, and the wide range of assignees of granted patents and applications, heightens the potential for increased licensing and litigation across industries, involving companies who in the past would never have crossed paths. According to the patent research firm Innography, there are at least 1,324 organizations or individuals listed as assignees on blockchain-related patents and patent applications

Not only will these patents bridge industries, but geographies as well. The World Intellectual Property Organization (WIPO), supported by data from Thomson Reuters, showed that the U.S. and China are the clear leaders in blockchain patents, with China growing significantly in 2017, accounting for over half of all blockchain patent applications

It is useful to note that many of the patents being issued are for improvements in blockchain processing operations or new uses of blockchain technology, as the original blockchain codes are open source

Blockchain Patent Insights

The predictive power of patents in markets is often overlooked or underappreciated. Since the 1970s, intangible assets, like patents and other intellectual property, have grown from roughly 17 percent of the S&P 500 market value, to over 80 percent by 2015. As intellectual property as a portion of total value has increased, so has its influence on market and firm performance. Patents also provide insight into which industries are adapting new technologies and which companies are likely to be market leaders. Considering comprehensive data of all worldwide blockchain patents, their assignees, and their relative strengths, we can make a number of predictions about the blockchain industry

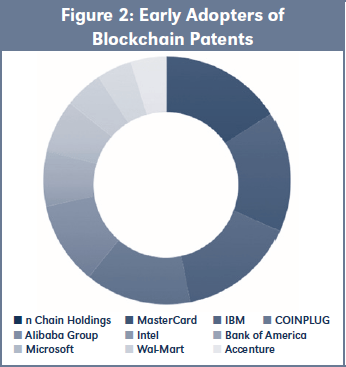

Figure 2 shows the early adopters of blockchain patents, and they comprise some of the major players in the tech and finance industries. We can expect to see these companies and their competitors in each of these industries continue their development of blockchain IP in the near to mid-term as the technology becomes more commonplace. The sooner organizations can obtain a strong blockchain patent portfolio for their given use-case, the more opportunities they will have to capitalize the patented technologies through application, licensing, sale and litigation

Figure 2 shows the early adopters of blockchain patents, and they comprise some of the major players in the tech and finance industries. We can expect to see these companies and their competitors in each of these industries continue their development of blockchain IP in the near to mid-term as the technology becomes more commonplace. The sooner organizations can obtain a strong blockchain patent portfolio for their given use-case, the more opportunities they will have to capitalize the patented technologies through application, licensing, sale and litigation

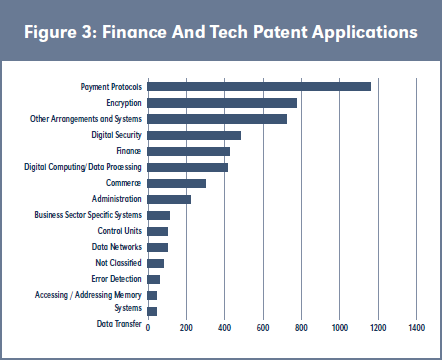

It’s logical that the finance and tech industries are well represented, as blockchain’s first and most established use-case was centered around a new technology to support financial transactions. It is also notable that financial applications have been, and are expected to be, the first widely adopted use of blockchain. Already, nearly every major U.S. bank has begun its own blockchain initiatives, along with numerous start-ups looking to enter the fintech space using blockchain. Figure 3 shows just how dominant financial applications have been up to this point in the patent application process

Payment Protocols lead the pack, accounting for 23 percent of all blockchain patent applications, which is unsurprising given the number of cryptocurrencies and payment applications that have been developed in recent years. However, Payment Protocols are not the only patent classification applicable to the finance industry. Encryption, Digital Security, and certainly Finance are all important features of a financial blockchain application, which together account for approximately one-third of all applications and grants. For financial firms and start-ups to successfully utilize the blockchain, it is imperative they cover all their patentable bases, including the encryption of the data, computing processes, and accessing of memory storage. Further, when examining strictly the “Encryption” classification of blockchain related patents, we find that nearly all the major assignees are tech-centric organizations. While one would expect LED patents to be owned by lighting companies, or pharmaceutical class patents to be held by pharmaceutical organizations, there is a wide range of technologies supporting blockchain (i.e. not just encryption). A company would need to not only have rights to their specific use-case of the blockchain, but the security, verification, and systems supporting it. Given the importance of security in banking, financial firms looking to implement blockchain into their processes will need to broaden the scope of their intellectual property from a financial or payment protocol focus to one that incorporates a variety of technologies to support their services, either through internal development or acquisitions and licensing

This analysis may seem particular to the financial industry, but it is analogous to nearly every industry looking to adopt blockchain. Organizations must build a quality IP portfolio in order to defend themselves and their products, develop new products and services, and simply stay relevant during the “blockchain-ization” of the global economy. Organizations that are not proactive in this pursuit risk the distressing costs of litigation, poor bargaining positions in licensing or, in extreme scenarios, complete obsolescence in the industry. As more patents are filed each day, the pressure rises for firms to begin the process of building not only a defensive portfolio, but ideally a valuable one

It is typical for patents to expire 20 years after their filing date, and because of the substantial increase in applications over the past few years, most blockchain patents will not expire until the mid-to-late 2030s. This is significant to any organization looking to utilize blockchain technology, as they will need to hastily develop or acquire patents to avoid the potential of suffering from lengthy and expensive licensing agreements, litigation, or worse yet and potentially costlier, exclusion from the market

For an organization to succeed using blockchain, whether that be via a blockchain-supported product, or the licensing of blockchain-related patents, it is equally as important to ensure the quality of the IP as it is to ensure its successful filing. In fact, whether a patent is presumed valid or simply issued gives no guarantee that it will remain that way. According to Stephen Kunin, former Deputy Commissioner for Patent Examination Policy at the USPTO, “Patent examination is an imperfect process that results in the issuance of patents that should not have issued. This is evidenced by the fact that in concluded IPR (Inter Partes Review) proceedings, only 10 percent of challenged patents had all original patent claims confirmed, and empirical studies have reported that 43 percent to 50 percent of all litigated patents are held invalid.”

Blockchain IP Portfolios, Litigation, Threats and Strategies

Often garnering allusions to the dot-com bubble and the influx of legal battles involved, blockchain looks to be the next arena for patent litigation. Companies are rushing to file patents, develop technology, and expand their blockchain efforts to prepare for this increasingly popular technology

Threats

In making strides toward the adoption of blockchain there will be a number of threats to businesses. Often companies will face litigation from competitors, or possibly Non-Practicing Entities (NPEs or “patent trolls”), as they adopt new technologies. The same assumption can be made with blockchain—as more organizations begin to implement and patent it, there will be more litigation of intellectual property associated with it. There is already evidence of organizations and NPEs gearing up for lawsuits regarding blockchain patents. Nick Spanos, founder and CEO of Blockchain Technologies, which has patented a blockchain based election voting system, has said a patent war “is inevitable” and that “legal battles will ensue.” Even though blockchain-based patent infringement litigation has been almost nonexistent, experts say lawsuits are almost certain, and “the wave of patent litigation is on the horizon.”

Another potential threat to companies looking to expand into blockchain is Alice-based Section 101 rejections. Since the 2014 decision in Alice Corp. Pty. Ltd. v. CLS Bank Int’l, courts have often invalidated software and “computer-implemented inventions” at an early stage. Alice builds on U.S. Patent Law Section 101 of Title 35 in stating that “merely requiring generic computer implementation fails to transform that abstract idea into a patent-eligible invention.” New uses of blockchains may face rejections if the new uses only require a network of standard computers performing standard computer functions without significantly more

IP Protection

The importance of IP protection going forward for this technology cannot be overstated. Although much of the core blockchain technology is open source, companies can expect to see patents covering a particular use-case intertwined with blockchain technologies to solve a problem within specific industries

Blockchain litigation may be years away, but the time to begin defending positions is now. Patent filings have grown at an exponential rate with over 740 blockchain patent publications worldwide in just September 2017, a 300 percent increase since January 2016. Experts do not expect that type of growth to slow down any time soon, some believing it will “be sustained for several years and that we will be looking at thousands of patents in a couple years.”

While protecting themselves against litigation from competitors or trolls, organizations must also be aware of tactics to avoid issues with the Alice ruling. Some of these tactics would be included in the claims security aspects like encryption, hashing, or digital signatures, networking aspects like consensus protocols, or smart contract protocols, and focusing on any distributed ledger features instead of transaction features. Luckily for companies looking to implement the blockchain, there are strategies to defend against most threats and protect themselves in this expanding technological space

Strategies

There are several core strategies that can be utilized by firms implementing or developing blockchain technology to their benefit. One of these strategies is a patent licensing strategy, in which a firm with rights or ownership of some of the patents necessary to implement blockchain for their particular use would go to market looking to license the remaining patents needed. It is a low risk strategy that can be used by most firms; however there is potential for this strategy to become expensive in the long run, as firms pile on royalty and up-front licensing payments. Another strategy would be to build a defensive portfolio of patents. Either through the development of original patents internally, or the acquisition of third party portfolios, firms can construct a quality portfolio of patents that would allow them not only to benefit from the implementation of such technology into their own business, but from the licensing and enforcement through litigation of the patent rights to other firms looking to do the same. This strategy, while costly in the near term, can have a significant impact on firm profitability going forward. Even non-practicing entities, sometimes called patent trolls, can benefit from this strategy by simply purchasing and litigating certain patents against other players in the market

With the growing popularity across a wide variety of industries, and recent upsurge of blockchain and decentralized ledger IP, the space is poised for significant growth in the years to come. There are many firms looking to be on the forefront of adopting blockchain, from start-ups to Fortune 500 giants, and with the right investments in intellectual property, as well as smart partnerships, these organizations can position themselves for success in the new of blockchain economy. ■

Available at Social Science Research Network (SSRN):

https://ssrn.com/abstract=3316992.