Ichiro Nakatomi

Avida Science, Inc.

President (2022-2023), Licensing Executives Society International

Shibuya-ku, Tokyo, Japan

Ichiro Nakatomi

Avida Science, Inc.

President (2022-2023), Licensing Executives Society International

Shibuya-ku, Tokyo, Japan Andreas Zagos

Management Partner

InTraCoM GmbH

Bonn, North Rhine-Westphalia, Germany

Andreas Zagos

Management Partner

InTraCoM GmbH

Bonn, North Rhine-Westphalia, Germany Dana Robert Colarulli

Executive Director, Licensing Executives Society International (LESI)

Partner, ACG Advocacy (acgadvocacy.com)

Washington, DC

Dana Robert Colarulli

Executive Director, Licensing Executives Society International (LESI)

Partner, ACG Advocacy (acgadvocacy.com)

Washington, DCThe world is obsessed with innovation. “Development” and “progress” have become watchwords, and we all expect things to continue to get more convenient, to be able to have what we want delivered to our doorstep more quickly, and to get wherever we need to go, faster. We describe it as wonderful, and various innovations have fundamentally changed and improved lives around the globe. But this drive towards progress— this drive to increase economic growth and life span—sometimes causes us to stop paying attention to aspects of new innovations that affect the quality of life.

What humanity has begun to notice is not just the need to reduce waste and pollution overall, but to also slow the increase in CO2 emissions from the energy consumption we have relied on during this innovation age. The global warming that has occurred has caused extreme climate disasters that have taken lives. Diseases, such as the human infection of Ebolavirus that occurred in 1976, have affected us globally as well. Most recently, although the cause of COVID-19 in humans is unknown, the big picture remains the same: human activity has destroyed natural habitats and harmed human life through contact with wild animals. This is the result of humanity’s self-centered activities for economic development. However, we are now entering a time when we can change the nature of some of these activities to instead improve the quality of life for humans.

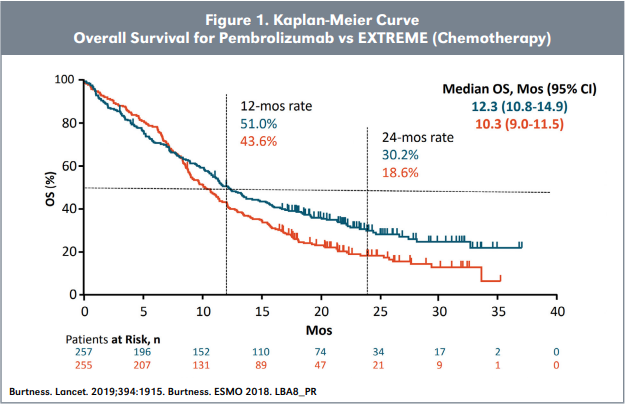

One of our authors, Ichiro Nakatomi, has been involved in development of anti-cancer drugs for many years since he was a junior high school student with the idea of creating a drug that would give his parents longevity. With about half of the human population suffering from cancer, researchers are striving to extend the life span of those who contract this disease by just a few months. See Figure 1: Kaplan-Meier curve on page 76.

Fig. 1 This graph shows that the average life expectancy of patients with head and neck squamous cell carcinoma (HNSCC) treated with conventional chemotherapy versus chemotherapy plus programmed cell death 1 (PD-1) inhibitors, Pembrolizumab, was extended by an average of two months. The Phase 3 trial was conducted with 882 patients at 200 sites in 37 countries between 2015 and 2017. It is one of the best recent cancer treatment outcomes and often fails to reach significance in trials of other therapies.

The focus and impact of these lifesaving efforts has been extensively discussed by some oncologists. They question whether a focus on increasing the survival rate of cancer patients alone, without considering quality of life aspects, will produce the best outcomes for patients. Certainly, there have been remarkable developments in diagnosis, surgery, and therapeutics that have reduced the size of cancers and increased survival rates—but perhaps that is not enough. Patients suffer from physical side effects and mental suffering caused by some new treatments and technologies. Perhaps instead the focus of our considerable investments in innovation should be—at least in part—to improve the quality of life while we are still alive?

This balance of driving innovation forward and considering quality of life aspects of the same must be actively addressed not only by social activities but also by industry. For many years, industries have been accountable for and reflected increases in sales and profits without consideration of the quality-of-life impacts of their innovations. Industry has been focused on its own survival. The intent of this article is to shift that focus by predicting a company’s future success based on its investments in innovation that provide a higher quality of life. Furthermore, the most important indicator for such companies may be the intangible assets it holds or creates.

In 2015, the United Nations hosted the Summit of Sustainable Development, which identified seventeen Sustainable Development Goals (SDGs) to be achieved to solve the world’s common challenges of the critical situation of global collapse. It alerted us to something we had almost forgotten: that it is a warning sign when societies and companies grow rapidly based on tangible assets, seeking convenience, developing technology, and bringing sales and profits to their companies. In 2017, the World Economic Forum was held in Davos. Leaders from various countries agreed upon SDG/ ESG targets as broad themes for the global economy and environmental issues. The four areas of hunger prevention, urban development, energy and resources, and health and welfare alone are targeted to generate at least $12 trillion in economic value and create up to 400 million jobs by 2030. Then the Global 100 (Corporate Knights)1 company rankings became focused as an indicator of SDG efforts published in February every year. See Table 1: 2022 rankings, on page 77.

| Table 1: 2022 Sustainable Corporation Rankings | |||||

|---|---|---|---|---|---|

| G100 Rank | Company | Headquarters City | Climate Commitments |

Overall Score |

|

| 2022 | 2021 | ||||

| 1 | 21 | Vestas Wind Systems A/5 | Aarhus | 1.5°C, SBTi | A+ |

| 2 | 24 | Chr Hansen Holding A/S | Horsholm | 1.5°C, SBTi | A |

| 3 | 43 | Autodesk Inc | San Rafael | SBTi | A |

| 4 | 1 | Schneider Electric SE | Rueil-Malmaison | 1.5°C, SBTi | A |

| 5 | 40 | City Developments Ltd | Singapore | 1.5°C, SBTi | A |

| 6 | 9 | American Water Works Company Inc | Camden (U.S.) | A | |

| 7 | 2 | Orsted A/5 | Fredericia | 1.5°C, SBTi | A- |

| 8 | 12 | Atlantica Sustainable Infrastructure PLC | Brentford (U.K.) | SBTi | A- |

| 9 | 55 | Dassault Systemes SE | Vélizy-Villacoublay | 1.5°C, SBTi | A- |

| 10 | 18 | Brambles Ltd | Sydney | 1.5°C, SBTi | A- |

| 11 | 57 | Sims Ltd | Mascot | A- | |

| 12 | 38 | Johnson Controls International PLC | Cork | 1.5°C, SBTi | B+ |

| 12* | 7 | Kering SA | Paris | SBTi, FCCA | B+ |

| 13 | 93 | Koninklijke KPN NV | Rotterdam | 1.5°C, SBTi B | B+ |

| 14 | 6 | McCormick & Company Inc | Hunt Valley | SBTi | B+ |

| 15 | Schnitzer Steel Industries Inc | Portland | B+ | ||

Table 1. This table shows the top 15 out of the 100 most sustainable corporations in the world given by Corporate Knights’ 18th annual rankings. It is based on a rigorous assessment of nearly 7,000 public companies with revenue over US$1 billion. 1.5°C: Business Ambition for 1.5°C, SBTi: Science Based Business Target initiative, FCCA: Fashion Chapter for Climate Action. |

|||||

The publication of such a corporate index, at least in advanced nations, is meaningful and worth considering. The companies’ rankings should be reflected more in their stock prices, as they are inherently valued by the companies themselves. The companies listed also enlist several to dozens of people per company on SDG/ESG initiatives to provide information, which has changed the mindset of corporate management. However, are these indicators really the right indicators for a company devoting efforts to comply with SDG/ESG? What elements must be added to effectively assess such efforts in innovative companies and should we not also measure a company’s intangible assets (and thus investment) focused on SDG/ESG, resulting in a more accurate corporate assessment?

The current effort seeks to focus further investments in innovations and take into account SDGs in all industries— and measure those investments. We believe that looking at the IP—intellectual property (the patents, designs, copyrights, and know-how) associated with those investments can be a measure of that company’s success. IP is one of the most strategically important assets for a company and the business development brought about by IP should also be evaluated as a source of income for the company and a sign of its future success.

We established the LESI SDG-IP Index Committee at the end of 2021 focusing on patents and utility models. Its members who responded consisted of Germany, France, Italy, Benelux, Japan and Thailand in LESI. So, we decided to start with the evaluation of a quantitative index.

The idea of how to compile the index was the result of the collaboration between Dr. André Gorius and Prof. Andreas Zagos, who reviewed the patent value data provided by Intracom and tested different signals. This data is based on a proprietary technology using artificial intelligence and machine learning techniques. Here, different indicators (up to 27) are applied over the bibliometric data of each patent and the algorithm calculates a value range for each patent family. The indicators address the areas of market coverage, market attractiveness, relative technical quality, and relative legal score of a patent family. The algorithm is trained with a database of real transactions from the past. The patent value data is used for many applications like benchmarking, sell/ buy/license, transfer pricing, M&A, or strategic analysis for macro research. Further financial products are launched, like the Nasdaq Innovators Completion Cap Index,2 which is investible over the ETF “QQQS.”

Besides the monetary patent value, Intracom enhanced the data on the SDG/ESG space by mapping the patents to sustainable technologies and calculating the value share of the sustainable patents to the non-sustainable. The idea is not only to measure the sustainability of a company based on the usage of resources or generation of emissions—like that which is available in current commercial ESG ratings—but also the output of a company’s developed sustainable technologies. This helps to identify and reward innovative companies which are really committed to sustainability and prevents greenwashing.

Further, commercially available sustainability ratings focus on historical data provided by the companies and thus forward-looking trends are mostly not tangible. Terms like Fair, Clean and Sustainable are often used but are lacking a clear definition. Thus, approaches which are transparent, forward looking and objective, and not relying solely on companies self-reporting, are highly desired. Patent information are very suitable to meet these criteria because they are based on 3rd party data and cannot be manipulated in order to achieve a better sustainable rating. Patent metrics are suitable to enrich an ESG profile of a corporation by making hidden information visible and making use of high quality, tamper-proof data. However, patents enlighten only one specific aspect: The R&D activities and their outcome. But this is an important and easy to gather “missing link” within an ESG assessment so far.

The signal used for the quantitative index was defined after several back tests and analysis of Intracom’s data to:

sustainable patent value/total assets

The idea behind this formula is to select the best companies based on their sustainable patent value relative to their size (represented by the total assets): highest rankings are attributed to the highest ratio. Further, there is a threshold of 10m€ on patent value for public listed companies in order to select companies who have a base number of patents and a reasonably valuable portfolio. Globally, 2,172,085 companies have patents. Among those, 21,703 are publicly listed with patents and a threshold over 10m€ on patent value.

The developed signal can be applied to the “E” inside the ESG ratings addressing environmental issues. An example of how the signal can be applied is given by the study of Corporate Knights in Table 2.

| Table 2. Comparison Of Corporate Knights Ranking With Sustainable Patent Value Ranking Of The Top 100 Companies | |||||

|---|---|---|---|---|---|

| No | Company Name | Ranking Corporate Knights |

Sustainable Patent Value/ Total Assets |

Country | |

| 1 | SAMSUNG SDI CO.,LTD. | 60 | 17,72% | KR | |

| 2 | OSRAM LICHT AG | 23 | 15,07% | DE | |

| 3 | NOVOZYMES A/S | 36 | 4,20% | DK | |

| 4 | VESTAS WIND SYSTEMS A/S | 21 | 3,43% | DK | |

| 5 | SEKISUI CHEMICAL CO LTD | 51 | 3,09% | JP | |

| 6 | BYD COMPANY LIMITED | 94 | 3,02% | CN | |

| 7 | TAIWAN SEMICONDUCTOR MANUFACTURING | 20 | 2,38% | TW | |

| 8 | VALEO SA | 66 | 2,15% | FR | |

| 9 | SIEMENS AG | 25 | 1,82% | DE | |

| 10 | MAXIM INTEGRATED PRODUCTS INC | 96 | 1,59% | US | |

| 11 | KONICA MINOLTA, INC. | 41 | 1,39% | JP | |

| 12 | ABB LTD | 33 | 1,18% | CH | |

| 13 | NESTE OYJ | 4 | 0,90% | FI | |

| 14 | METSO OYJ | 8 | 0,89% | FI | |

| 15 | INTEL CORP | 59 | 0,78% | US | |

| 16 | TESLA, INC. | 97 | 0,70% | US | |

| 17 | CANADIAN SOLAR INC. | 85 | 0,67% | CA | |

| 18 | HP INC. | 50 | 0,62% | US | |

| 19 | AUTODESK INC | 43 | 0,60% | US | |

| 20 | DASSAULT SYSTEMES SE | 55 | 0,55% | FR | |

| 21 | LENOVO GROUP LIMITED | 78 | 0,51% | HK | |

| 22 | SCHNEIDER ELECTRIC SE | 1 | 0,44% | FR | |

| 23 | ANALOG DEVICES INC | 74 | 0,43% | US | |

| 24 | UPM-KYMMENE OYJ | 22 | 0,37% | FI | |

| 25 | EISAI CO LTD | 16 | 0,37% | JP | |

| 26 | ALSTOM S.A. | 39 | 0,28% | FR | |

| 27 | JOHNSON CONTROLS INTERNATIONAL PLC | 38 | 0,27% | IE | |

| 28 | ALPHABET INC. | 90 | 0,25% | US | |

| 29 | ACCENTURE PLC | 61 | 0,24% | IE | |

| 30 | OWENS CORNING | 15 | 0,24% | US | |

| 31 | HENKEL AG & CO. KGAA | 88 | 0,24% | DE | |

| 32 | NVIDIA CORP | 100 | 0,21% | US | |

| 33 | TRANE TECHNOLOGIES PLC | 26 | 0,20% | IE | |

| 34 | AKZO NOBEL NV | 28 | 0,15% | NL | |

| 35 | TELEFONAKTIEBOLAGET LM ERICSSON | 89 | 0,15% | SE | |

| 36 | CHR. HANSEN HOLDING A/S | 24 | 0,11% | DK | |

| 37 | CISCO SYSTEMS INC | 13 | 0,09% | US | |

| 38 | SYSMEX CORPORATION | 32 | 0,07% | JP | |

| 39 | ORSTED A/S | 2 | 0,07% | DK | |

| 40 | ACCIONA S.A. | 31 | 0,07% | ES | |

| 41 | ASTRAZENECA PLC | 82 | 0,06% | GB | |

| 42 | ADIDAS AG | 76 | 0,05% | DE | |

| 43 | UNILEVER PLC | 79 | 0,05% | GB | |

| 44 | BRAMBLES LIMITED | 18 | 0,04% | AU | |

| 45 | TAKEDA PHARMACEUTICAL CO., LTD. | 71 | 0,04% | JP | |

| 46 | HEWLETT PACKARD ENTERPRISE COMPANY | 30 | 0,03% | US | |

| 47 | SANOFI | 65 | 0,02% | FR | |

| 48 | KONINKLIJKE KPN NV | 93 | 0,02% | NL | |

| 49 | BALL CORP | 48 | 0,02% | US | |

| 50 | ARCELIK A.S. | 34 | 0,02% | TR | |

| 51 | SAP SE | 84 | 0,02% | DE | |

| 52 | PEARSON PLC | 75 | 0,01% | GB | |

| 53 | NOVO NORDISK A/S | 98 | 0,01% | DK | |

| 54 | BT GROUP PLC | 35 | 0,00% | GB | |

| 55 | COMERICA INCORPORATED | 52 | 0,00% | US | |

| 56 | BANK of MONTREAL | 47 | 0,00% | CA | |

| 57 | SHINHAN FINANCIAL GROUP | 83 | 0,00% | KR | |

The main conclusion from this comparison is that the sustainable patent value can be used as an additional factor because there is no direct correlation between the Corporate Knights metrics and the sustainable patent value. For patent experts these metrics can be used to develop new services by supporting companies in the sustainability reporting. For reliable comparisons sector benchmarks are also available and the sustainable patents and values are mapped to the SDGs. ■

Available at Social Science Research Network (SSRN): https://ssrn.com/abstract=4375135.

Author’s note: Part II of this article will be published later in 2023 and will include further analysis of the initial findings of this study as well as feedback on its results as a true indicator of success for those companies investing in technologies responding to one or more of the SDGs. Our hope is that this indicator— and/or the factors we identified here—will be incorporated in other public measures of corporate success. The current SDG-IP Index Committee members are Andreas Zagos, Bruno Vandermeulen, Rinaldo Plebani, Thierry Vanbeckhoven, Véronique Blum and Suracha Udomsak.