Ashley J. Stevens, D.Phil (Oxon), CLP, RTTP

President,

Focus IP Group, LLC

Winchester, MA

Ashley J. Stevens, D.Phil (Oxon), CLP, RTTP

President,

Focus IP Group, LLC

Winchester, MAThis article looks at sublicense income payment provisions in academic licenses. A majority of academic licenses are granted to small companies which are likely at some point to grant a sublicense to a large company to take the product to market. The article examines the three structures that have evolved to share the payments received by the small company from its sublicensee with its academic licensor and then looks at problems that have risen over the issues of milestone payments and profit sharing arrangements.

Some 65 percent of academic licenses in 2015 were granted to small companies. Such companies frequently carry out the early development work on a new technology, reducing both technical and market risk, and then sublicense either the technology itself or a product developed from it to a larger company with the resources to complete high-cost, late stage development, manufacturing and global distribution of the finished products. The small company can create and realize substantial value from these sublicenses, and the university will want to share in this value creation, through sharing in the licensee's income from its sublicensees. These sublicense income sharing provisions are frequently one of the most hard fought items when a university negotiates a license with a small company.

The major problem in negotiating these sublicense income sharing provisions is that the negotiators need to anticipate and provide for a transaction that has not yet occurred and likely will not occur for a number of years, if at all. They won't know the relative strengths of the licensee and its potential sublicensee(s) in the negotiations for the sublicense and they won't know what its financial structure or terms will be. They won't know how much of the value created in the sublicense is attributable to the academic technology and how much is attributable to the know-how and new inventions created by the licensee.

A major priority of the university in these negotiations will be to ensure that its licensee can't "game" the system and structure a sublicense transaction in such a way as to reduce its payments to the university. For its part, the licensee will want to retain the flexibility to be able to structure its deals in whatever way creates the maximum value and not to be incentivized to adopt a disadvantageous deal structure in order to minimize its payments to the university.

To achieve these aims, universities seek to share in all the payments received by its licensee from sublicensees with a couple of well defined exceptions, and universities have developed three broad structures for sublicense income sharing:

1. An Allocation

In this structure, the university receives (i.e., is allocated) a set percentage of every payment the licensee receives from its sublicensee, but generally excluding certain types of payments for which the licensee has a deliverable (e.g., reimbursements for research the licensee carries out for the sublicensee, product manufacture and purchases of equity in the licensee by the sublicensee).

The advantage of this approach is its inherent simplicity—the licensee cannot game the system and the university receives a share of every payment the licensee receives. Its disadvantage is that it is a blunt instrument—the percentage picked may be too high for some payments and too low for others.

In some deals, the parties agree that the allocation percentage will step down the closer the technology is to market when the deal is done, the philosophy being that as the licensee invests more and more in developing the technology, then more of the value it is receiving from the sublicensee reflects the licensee's investment and less reflects the value of the technology that was originally licensed. Step downs are most easily done when there are universally accepted milestones on the technology's pathway to the market, such as the stages of pre-clinical and clinical development of drugs and devices. Outside of healthcare where milestones are more industry-specific and whether they have been achieved may be subject to dispute, the time from the original license or the amount invested by the licensee in developing the technology may be better step-down mechanisms.

2. A Tiered Allocation

In this approach there are at least two allocation percentages, most commonly one for payments received by the licensee pre-commercialization and a second for payments received by the licensee after the technology has been commercialized.

The pre-commercialization percentage is generally the lower of the two, to allow the licensee to utilize more of the pre-commercialization payments it receives (upfront fees, milestone payments, etc.) to develop the technology and for corporate development purposes. If the university has received equity in the licensee as part of the original deal, such an approach benefits the university by reducing the amount of capital the licensee needs to raise, and so reducing dilution of the university's ownership percentage.

Once the licensed technology is successfully commercialized, the licensor generally receives a higher percentage of the running royalties the licensee receives from the sublicensee—with the starting point for the discussions typically being the 25 percent specified by the Goldschieder Principle.

3. A Pass Through

In the previous two approaches, the university gives up control of the running royalties it receives from the eventual commercialization of the licensed technology. Suppose the university and the licensee agreed on a running royalty of five percent of Net Sales and that the allocation percentage is 25 percent of payments received by the licensee. The university will receive less than the five percent of the sublicensee's sales of the Licensed Products unless the licensee is able to negotiate a running royalty of 20 percent or more of its sublicensee's Net Sales. For instance, if the licensee negotiates a running royalty of 16 percent of Net Sales by its sublicensee, then the university will receive four percent of the sublicensee's Net Sales (16% * 25% = 4%), 20 percent less than the five percent royalty rate for Net Sales by the licensee.

The Pass Through approach therefore says "If we agreed the university should get five percent of the licensee's Net Sales, then the university should also get five percent of the sublicensee's Net Sales—i.e., the running royalty is "passed through" to the sublicensee's sales."

Early academic licenses were primarily concerned with running royalties and only included the royalty pass through. As their licensee's deals started to include substantial pre-commercial payments and sales milestones, an allocation provision was added to also capture a share of payments other than running royalties for the university. As deals started to include upfront and contingent milestone payments ("BioBucks") of over $1 billion, this became an important source of revenue to universities—10 percent of $1 billion is $100 million.

Whether a licensee will agree to a pass through structure will depend on the royalty rate to which it is prepared to agree and its expectation of the royalty rate it is likely to be able to achieve down the road from its sublicensees. If it feels that the royalty rate it agreed to pay is less than 25 percent of the royalty rate it will be able to secure from its sublicensees, it will agree to a pass through; conversely, if it feels that the royalty rate it has agreed to is more than 25 percent of the rate it will be able to obtain, it will seek to negotiate an allocation or tiered allocation.

Two recent disputes between the Regents of the University of California ("Regents") and Medivation, Inc. ("Medivation") illustrate the need for parties to think through the definitions of sublicensing income extremely carefully.1

The first dispute concerned sales milestones while the second concerned how profit sharing payments received by Medivation from its licensee, Astellas, should be handled. The first dispute went to a bench trial, and the judge's ruling was appealed to the First Appellate District for the California Court of Appeal and then to the Supreme Court of California and upheld. The second dispute was settled after jury selection was complete but before the start of arguments. The terms of the settlement are confidential.

In 2005, Regents licensed a series of about 170 diarylthiohydantoin compounds to Medivation that were synthesized by Drs. Michael Jung and Charles Sawyers at UCLA. The compounds bind to and inhibit the androgen receptor and showed promise as a treatment for advanced prostate cancer. The terms of the license included an annual maintenance fee, milestone payments totaling $2.8 million, a royalty rate of four percent which was passed through to sales by sublicensee(s) and 10 percent of Sublicensing Income payments.2

Medivation selected one of the compounds, code-named RD-162', developed it under the name MDV31003 and started Phase 3 testing in October 2009. Also in October 2009, Medivation signed a partnership with Astellas. Terms of that deal included an upfront fee of $110 million, developmental milestone payments of up to $335 million and sales milestone payments of up to $320 million. The parties agreed that Medivation would co-develop and co-promote MDV3100 in the Shared Territory (the U.S.) and would receive 50 percent of Operating Profits and Operating Losses. In the Licensed Territory—the rest of the world ("RoW")—Astellas was responsible for all development and commercialization activities and Medivation received tiered running royalties based on Net Sales, with the royalty rate ranging from the low teens to the low twenties.4

MDV3100 received FDA approval on August 31, 20125 and is sold under the tradename Xtandi. Foreign approvals followed and Xtandi® has been extremely successful with 2015 sales of $2.2 billion. In March 2016, Regents monetized their royalty rights for up to $1.14 billion, having previously received around $300 million in running royalty payments and sublicense sharing payments. In August 2016, Pfizer acquired Medivation for $14 billion.

Since around 1996, Regents has used a standard definition of Sublicensing Income in their agreements that are structured as pass throughs:

"Sublicensing Income" means income received by Licensee under or on account of Sublicenses. Sublicensing Income includes income received including, but not limited to, license issue fees, milestone payments, and the like but specifically excludes royalties on the sale or distribution of Licensed Products or the practice of Licensed Methods, [research support] and [purchases of equity].

As noted above, Medivation's deal with Astellas included up to $320 million in sales milestone payments. Medivation argued that sales milestones were triggered by the achievement of certain levels of sales and were, therefore, a royalty on sales. These were included in the exclusion of "royalties on the sale," which were included in the definition of Sublicensing Income. Regents argued that sales milestones were a form of milestone and therefore included in "milestones and the like."

In his ruling, Judge Munter noted:6

The term "milestone payments" found in the above definition of Sublicensing Income is 28 not defined in the [Agreement]. In the context of licensing agreements such as the [Agreement], the term "milestone payments" is commonly understood in the industry to mean event-driven or success payments, which are distinct from royalty payments. It is also commonly understood in the industry that the term includes payments made upon the occurrence of both regulatory milestones and sales milestones.

Judge Munter continued to analyze the difference between sales milestones and royalties as follows:7

Each sales milestone payment is owed only once, and the maximum total payment owed to Medivation is $320 million. Unlike sales milestones, royalties are triggered by individual sales, they are based only on sales outside of the U.S., and they are recurring.

Medivation was ordered to pay Regents $32 million—10 percent of $320 million.

Judge Munter's ruling was appealed to the First Appellate District for the California Court of Appeal and then to the Supreme Court of California, which both affirmed Judge Munter's ruling.8

In a subsequent dispute, Regents contended that the profit sharing payments received by Medivation in the Shared Territory are not royalties and hence not covered by the exclusion of "royalties on the sale" from what is included in Sublicensing Income and so should be included in Sublicensing Income. Medivation contended that the Astellas Agreement granted Astellas a sublicense to Regents' patents and so Regents were due only the four percent pass through royalty.

Table 1 shows Astellas' Net Sales and Operating Profits and Losses reported by Medivation in their 10-K's together with the 50 percent of Operating Profits and Operating Losses Medivation received.9 The profit margin of Xtandi® was close to 70 percent in 2015, the third year of sales, so Medivation's 50 percent share was approaching 35 percent of total Net Sales. If these payments were to be considered part of Sublicensing Income, Regents would receive 10 percent of this, or about 3.5 percent of Net Sales. Since Regents were already receiving their pass through running royalty of four percent, this would have had the impact of almost doubling the running royalty rate in the Shared Territory.

As noted above, this dispute did not proceed to a judicial decision and appellate review, which would have provided definitive guidance to licensing professionals. However, the dispute does raise interesting issues of what exactly a profit sharing arrangement is and how it should be interpreted when determining sublicense income.

The purpose of this article is to examine the issues the case raised. The Regents-Medivation case will be referred to extensively because the key documents are in the public domain, albeit some are redacted, and the financial aspects of the relationships are well documented in Medivation's 10-K's.

A. What Is a Royalty?

The term "royalty" can be traced back to Tudor England. The English Crown would grant monopolies on discrete segments of the English economy. The grant would be via "Letters Patent," an instrument used for a variety of royal purposes—granting an office, right, monopoly, title, or status to a person or corporation, creating a corporation or government office, granting city status or a coat of arms, etc. Initially, the purpose of creating a monopoly was to induce foreign craftsmen to bring new technologies to England to establish new industries. Early examples were the introduction of glassblowing and silk cultivation and weaving from Venice. Later, monarchs granted monopolies over established industries and used them as an alternative to taxation to fund wars—the recipient of the monopoly would share part of their profits with the Crown. This share therefore came to be known as "royalties." Henry VIII, Elizabeth I and James I were particularly prolific granters of monopolies and after a vigorous debate throughout the early 1600s, the Monopolies Act of 1623 was passed, which abolished a number of existing monopolies and restricted the granting of new monopolies to new industries, where there would be no incumbents to be disrupted. This was the origin of the linkage of royalties to patents on innovations. However, the broader origin of the term is as a share of profits.

The Goldscheider Principle, aka the 25 percent Rule, alluded to above, established an empirical quantitative relationship between a product's profitability and the appropriate share of profits the licensor should receive as a running royalty rate. The Federal Circuit's Uniloc decision determined that the 25 percent Rule is too imprecise a tool to be used to calculate damages in infringement cases, but it remains an important principle in licensing.

B. What is a Running Royalty?

Expanded names for royalties tie the payments to the extent of a licensee's use of the licensed technology more explicitly:

The Federal Circuit has described a running royalty license:

In a running royalty license, the amount of money payable by the licensee to the patentee is tied directly to how often the licensed invention is later used or incorporated into products by the licensee. A running royalty structure shifts many licensing risks to the licensor because he (sic) does not receive a guaranteed payment. Royalties are dependent on the level of sales or usage by the licensee, which the licensee can often control.10

Judge Munter's definition of a running royalty quoted above is entirely consistent with the Federal Circuit's description.

Brunsvold, the text regarded by many as the definitive reference work on patent licensing agreements11 doesn't even include a recommended definition of royalty payments for inclusion in a license agreement, but instead devotes an entire chapter on how to unambiguously specify how to determine the amount of royalty payments due under the agreement. In the introduction to this chapter, Brunsvold states that royalties are

incremental payments proportioned in some way to the extent of use of the licensed inventions.12

Brunsvold goes on to state:13

Contract drafting in respect to royalty payments divides itself rather naturally into (1) the problem of defining the royalty base on which the royalties are to be computed and (2) the procedures under which royalties are to be calculated, reported and accounted for.

In other words, a running royalty payment can be expressed as a formula:

Royalty Payment = Royalty Base* Royalty Rate

where:

the Royalty Base specifies in what aspect of the licensee's successful use of the technology the licensor will share; and

the Royalty Rate specifies how much of that success the licensor will receive.

C. The Royalty Base

The royalty base is some measure of the licensee's extent of use of the licensed technology and is generally related in some way to the licensee's sales of licensed products. Suitable measures include:

Brunsvold notes:

The most common royalty bases are the sales price (net or gross) of the licensed product or a fixed amount for each licensed product sold or manufactured.

Net Sales is certainly the most common royalty base encountered, particularly in life sciences, but not the only royalty base. It is also the most common, but again not the only, royalty base found in academic licenses.

D. Using Profits as a Royalty Base

Brunsvold writes:14

A licensee's profit on a licensed product and the licensee's cost of the licensed product are both tempting [royalty] bases, since each has some direct relation to the licensee's use of the licensed technology. Before selecting such a base, however, the licensor should consider the variable definitions for profit and cost under generally accepted accounting principles and the licensee should consider whether it wishes to disclose to the licensor its profit or cost figures. If such a royalty base is to be used, care should be taken to define, to the extent reasonable and possible given principles of accounting, exactly what profit or cost the parties contemplate.

In other words, Brunsvold teaches us that the licensee's profits and losses are a perfectly valid and acceptable royalty base for licensor and licensee to agree to as a business proposition, but a base that presents challenges in both definition and implementation.

As Brunsvold notes, one of the major issues with using profits as a royalty base is that the licensee may be unwilling to share its profit margins with the licensor, particularly if they are competitors. If the licensor is an academic institution, the licensee may have concerns about the ability of the academic institution to maintain the confidentiality of such sensitive information.

Another issue with using profits as a royalty base is in auditing the licensee. Information flow in a license agreement is highly asymmetric—the licensee generally has most or all the information and chooses what to share with the licensor. Depending on the product and the licensee—whether the licensee is a publicly traded company or not—the licensor may have limited ability to independently verify what the licensee is telling it about the product's sales. Hence the importance of audit provisions in license agreements. In the immortal words of Ronald Regan: "Trust ……. but verify."

An audit is paid for by the licensor.15 It will need to hire a CPA, who will visit the licensee and verify all the numbers that the licensee has reported to the licensor. The more figures to be verified, the more the audit will cost. Auditing license agreements that are based on profits is therefore likely to be considerably more expensive for the licensor than auditing license agreements where the royalty base is Net Sales or units sold—the farther down the P&(L) statement of the measure of profits that is used as the royalty base (gross profits, net profits, net profits after interest and depreciation, etc.), the larger the number of figures the auditor will need to verify, and so the higher the cost of the audit.

A related issue is that the licensor may have concerns that the licensee will be tempted to manipulate its books in some way to minimize the reported profits and hence the royalties owed. Although the license could specify that accounts will be maintained in accordance with Generally Accepted Accounting Principles ("GAAP"), verifying that they have in fact been kept in accordance with GAAP could be an extremely expensive undertaking.

E. When to Use Profits as a Royalty Base

However, despite these considerations, there may be overwhelming business reasons to use profits as the royalty base. For instance, licenses in the generic drug industry are very frequently expressed in terms of gross profits, because the profitability of a generic drug varies enormously depending on how many companies are selling the drug in the particular time period, and the number of market participants can change very rapidly based on Hatch-Waxman Paragraph IV exclusivity expiration and FDA approvals.

The definition of Gross Profits in such agreements is typically:

Gross Profits = Net Sales—Cost of Goods Sold

Since most generic drug companies purchase their Active Pharmaceutical Ingredient ("API") from a third party, the Cost of Goods Sold is relatively straight forward for the auditor to verify.

However, absent a specific business reason such as this, as a general proposition, profits are likely to be a relatively unattractive royalty base to use to share a small amount of the value created by a license. In these circumstances, a royalty base that uses some measure of sales is likely to be a better choice. However, as will be discussed below, if the parties are planning to share a large amount of the value created by the sublicense—say 40-50 percent—a royalty base that uses a measure of profits is likely to be a better choice, because at the end of the day, value is about profits.

F. The Biotechnology Industry

Drug discovery and development is a high risk, high return business.

It is high return because a successful, patent protected drug can achieve very high sales at a very attractive profit margin. Many start-up drug companies therefore aspire to become what is termed a FIPCO or FIBCO—a fully integrated pharmaceutical company or fully integrated biopharmaceutical company—i.e., a company which discovers, develops, manufactures and markets its own drugs.

It is high risk because the cost to take a drug all the way from invention to FDA approval is $2.9 billion according to the most recent estimate by the Tufts Center for the Study of Drug Development.16 Once approved, the drug must then be manufactured using Good Manufacturing Practices in very expensive facilities and marketed by highly trained sales representatives, supported by an extensive advertising budget.

Acquiring both the financial and human resources needed to become a FIPCO or FIBCO is therefore a daunting task for a start-up biopharmaceutical company, and it is very unusual for a start-up biotechnology company to take its first drug to market itself and become fully integrated. In a study of 153 academic drug discoveries that were successfully developed and received FDA approval, in 23 of the cases the initial licensee was a start-up company—the others were either existing small companies or large companies.17 Of the 23 start-up companies, only one took the drug to market itself, Alexion, which licensed technology from Yale and the Oklahoma Biomedical Research Foundation that became Soliris.

G. Deal Making in the Biotechnology Industry

Biopharmaceutical companies are generally founded with in-depth research expertise in the particular area of science on which their drug development programs are based, and also need well developed business development and capital raising capabilities. They generally seek to manage the financial risks of drug development, particularly with their first drug, by seeking to form a partnership with a large, established pharmaceutical company when they have developed strong evidence that their drug will ultimately prove to be safe and effective. The pharmaceutical company generally provides funds for the large-scale pivotal trials needed to receive FDA approval, manufacturing and global distribution, and it has employees experienced in clinical development, interacting with the FDA, manufacturing, distribution, marketing and sales.

The start-up biotechnology company's objectives in such a partnership will be, first, to obtain a financial return that the company can use to fund its next drug development project—hopefully a sufficiently large return that it will be able to take its second product to market itself—and, second, to start to acquire the human resource skills needed to build out the company's capabilities and become a FIPCO or FIBCO as the case may be.

The start-up biotechnology company will generally seek to take its drug candidate as far down the development path as its ability to raise capital will permit. As each stage of clinical development is successfully achieved, the risk of the drug failing to receive FDA approval is reduced, and its value correspondingly goes up. Upfront payments, milestone payments and royalty payments all normally increase the closer the drug gets to FDA approval when a deal is done. The account of Xtandi above shows how its value went from $2.8 million at the preclinical stage to $765 million when it entered Phase 3.

In most such partnerships, the closer the drug gets to the market, the more of the future effort will be the responsibility, both financially and operationally, of the pharmaceutical company, and the biotechnology company's role generally diminishes. The pharmaceutical company generally pays all the future costs of development, usually including paying the biotech company to assist with the early stages of development. The biotechnology company sublicenses its rights to sell the drug to the pharmaceutical company, which normally has the sole responsibility for commercialization, at which point the biotechnology company's role transitions to being largely passive. It will receive its quarterly royalty checks and, depending on the deal structure, occasional checks when sales milestones are reached, but otherwise is uninvolved in the commercialization process. It achieves its financial objectives but not its human resource development objectives.

H. Profit and Loss Sharing Arrangements in the Biotechnology Industry

If a drug candidate appears sufficiently attractive—i.e., if it offers a sufficiently great improvement over existing therapy, in a disease with a large number of patients who are inadequately treated by current treatment modalities—then the biotechnology company may be able to negotiate a more attractive deal that is a hybrid between passive receipt of royalties and retaining full responsibility for commercialization.

Such a deal is a co-development and co-promotion partnership. The biotechnology company becomes the junior partner of the pharmaceutical company. It continues to participate in the development of the drug all the way through pivotal trials and FDA submission and approval, both operationally, carrying out a significant part of the work, and financially, paying for an agreed upon percentage of the costs. It then has a role in the marketing of the drug, normally in the U.S. for U.S. biotechnology companies, specifically through the detailing process, in which sales representatives call on prescribing physicians and bring to their attention the unique attributes of the drug, as evidenced by published studies.

Such an arrangement enables the biotechnology company to start to develop its human resources, because it will need to hire individuals who can manage late stage clinical trials and a sales force, and it will have the opportunity to learn how to manage these resources from its pharmaceutical partner.

Such arrangements have a very different financial profile from those of a passive sublicensing deal. The biotechnology company will be financially responsible for some agreed percentage of the late stage development costs, which as discussed above, can be very substantial. Depending on the speed at which sales take off, the drug may remain unprofitable in the early stages of commercialization, and the biotechnology company may have to continue to fund its share of the losses for some time.

In these types of deal, instead of a running royalty based on the pharmaceutical company's Net Sales, the biotechnology company receives a percentage of the profits from selling the drug. Depending on the gross profit margin of the drug and the general, administrative and selling costs of the pharmaceutical and biotechnology companies' combined efforts, such a profit share can return a significantly higher percentage of the sales revenue of the drug to the biotechnology company than it would have received from a passive royalty stream. Longer term therefore, when the drug has swung into profitability, such an arrangement will be a more attractive financial option for the biotechnology company.

The biotechnology company remains a junior partner in such an arrangement because the pharmaceutical company has exclusive rights to the product, generally owns the FDA approval, books all the revenues from selling the drug, manages distribution of the drug, and so forth, and of course has sole development and marketing responsibility outside of the co-development and co-promotion territory.

These sorts of arrangements are becoming more common. A 2008 article reported that half of the recent Phase II and Phase III deals that had been done included co-promotion and/or profit sharing.18 In the "LES Global Life Sciences Royalty Rates and Deal Terms Survey" for 2014, 29 percent of the 24 deals that didn't have a royalty rate based on Net Sales included a profit sharing arrangement.

I. Profits as a Royalty Base in the Biotechnology Industry

Many of the issues with using profits as the royalty base disappear in the partnerships that biotechnology and pharmaceutical companies establish.

First, the relationship between them is not a relatively passive licensor/licensee relationship. In contrast, academic licenses are typically passive. They generally don't provide for the academic institution to supply any technical assistance to the licensee beyond possibly a minimal amount to transfer the know-how associated with the technology. Indeed, many universities don't even include know-how in their licenses, on the basis that the know-how resides in the head of the professor, and if the licensee needs access to it, they should hire the professor directly as a consultant. If the licensee needs the university's help to further develop the technology that is generally handled through a separate Sponsored Research Agreement, it may have to be negotiated by a separate office within the university.

By contrast, the relationship between licensor and licensee in the biotech industry is much more active. The agreements are generally titled "Collaboration Agreement," not "Exclusive License Agreement." The licensor is invariably involved in the completion of the research phase, and may be involved in the development phase, the early manufacturing phase, and even in the commercialization of the product through co-promotion.

The agreements specify the categories of costs that the parties have agreed to share, and how to calculate these costs in great detail. The parties will generally report the revenues and expenses to each other quarterly and the party that has incurred less than its agreed share of costs will make a "true up" payment to the other. Both parties will both generally be publicly traded and will have one of the Big Four auditors.

J. Is a Profit Share a Running Royalty?

The Regents' sublicense income language excluded "royalties on the sale" of Licensed Products paid by sublicensees to Medivation from inclusion in Sublicensing Income and Medivation was not required to pay 10 percent of such royalties on the sale to Regents—Regents instead received four percent of sublicensee sales under the pass through.

Whether profit sharing payments constitute "royalties on the sale" was therefore the central issue in the dispute.

Medivation filed a redacted copy of its Collaboration Agreement with Astellas as part of its 10-K for the period ending December 31, 2009.

The Agreement stated in §8.1 that Medivation granted Astellas an exclusive (even as to Medivation) royalty-bearing, sublicensable license to the Medivation Technology and sublicense to the UCLA Technology.

§9, Financials, specified the payments discussed above, totaling $765 million in §9.1 (License Fee, $110 million), §9.4 (Regulatory Milestone Payments, up to $335 million) and §9.5 (Sales Milestone Payments, up to $320 million). In §9.2 it specified the mechanisms for reconciliation / reimbursement of various categories of costs for the Shared Territory (the U.S.) prior to commercialization and in §9.3 the mechanisms for profit sharing in the Shared Territory following commercialization. In §9.6 it specified the royalties payable in the Licensed Territory (RoW).

The Agreement made a clear distinction between the 50 percent of Operating Profits and Operating Losses that Medivation would receive in the U.S. and the Royalties that it would receive in RoW. It did not state why the payments were being made nor why Medivation received different amounts in the two territories. In these respects, the Astellas-Medivation agreement is entirely typical of profit sharing deals the author has reviewed, and the UCLA-Medivation deal is typical of pass through academic deals.

The balance of this article, therefore, discusses the general concepts involved, not the wording of these two specific agreements.

The question remains, therefore, is a profit share a "royalty on the sale" of a Licensed Product and therefore excluded from Sublicensing Income?

The term "royalties on the sale" in the exclusion from Sublicensing Income is broad, and has to be broad, because the academic institution and its biotech licensee will have negotiated their deal years before the biotech will negotiate its pharma deal. They have no idea what the pharma deal will look like nor how it will be structured. However, they have agreed that the academic institution will receive the same running royalty on the pharma's Net Sales of the Licensed Product as it would have received if the biotech had sold the product, so they seek to exclude the royalties the biotech receives from the pharma from Sublicensing Income, no matter how the royalty payments are structured.

K. Is a Profit Share a Running Royalty?

The key question therefore is: "Is a profit share a running royalty?"

In the author's opinion, the answer to this question has to be "Yes" for the following reasons:

First, as discussed above, the origin of the term royalties was a share of the profits earned from a monopoly.

Next, also as discussed above, operating profits are a normal royalty base, albeit a less common base than Net Sales, though in some sectors, such as generic drugs, profits are the norm. There is at least one instance of an academic institution agreeing to use profits as a royalty base which is in the public domain 19 and, anecdotally, discussions with academic licensing professionals indicate there are more examples which are not public.

Next, operating profits are a measure of the extent of the licensee's use of the licensed technology, a requirement for a royalty base, though the relationship is not a linear relationship as is the case with Net Sales. Table 1 shows that Astellas' Operating Profits increased more rapidly than Net Sales. The relationship between profits and sales is not linear but as sales increase, so do operating profits.

Third, the share of profit share that the biotech receives from its pharma partner is generally the only compensation that the biotech receives from the pharma's sales and at least part of the profit share has to be the compensation the biotech receives for having granted a license to its IP and the sublicense to the academic IP.

L. What Else Does a Profit Share Do?

Table 1 shows that Medivation receives almost twice as much as a percentage of Astellas' Net Sales in the U.S. as it does in RoW. The next question is therefore, "What does the balance represent?"

The difference in the business arrangements between Medivation and Astellas in the U.S. and RoW is that in the U.S. Medivation contributed 50 percent of the development costs, whereas it did not contribute to the development costs outside the U.S.

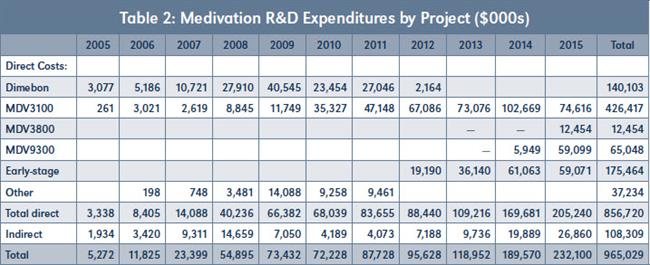

Unlike most biotechs and pharmas, Medivation broke down its R&D spend by project in its 10-Ks. Its R&D expenditures by project, including Xtandi® (MDV3100), are shown in Table 2.20

It is clear that, rather than ceasing after they had obtained their pharma partner, Medivation's R&D expenditures on Xtandi® accelerated dramatically after the October 2009 deal with Astellas, reflecting the 50:50 cost sharing aspect of the deal in the U.S. Allocating the indirect costs proportionately across all the specific projects, Medivation spent a total of $482 million developing Xtandi, $448 million of which was spent after the deal with Astellas was signed.

Table 1 shows that Medivation was receiving close to twice the percentage of Xtandi's sales in the U.S. as in RoW, so the higher running royalties in the U.S. are providing a return to Medivation on this investment.

M. Royalties as a Return on Investment

Licensing professionals generally think of running royalties as a method of compensating a licensor for a license to use their intellectual property. Less commonly, they can also be used to compensate investors for investing in developing drugs. The investor is taking on the risk that the drug will not be successful and so will demand a big upside to compensate them for this risk.

One of the best known examples of royalties being used to provide a return to an investor is the venture philanthropy program of the Cystic Fibrosis Foundation ("CFF"), which raises money philanthropically and invests it in companies developing treatments and cures for cystic fibrosis.

Its best known program has been with Vertex Pharmaceuticals. Since 1998 CFF has invested some $150 million21 in funding Vertex and a predecessor company, Aurora Biosciences, to discover and commence clinical development of the molecules that became Vertex's products Kalydeco and Orkambi plus various triple FDC products currently in late stage development. CFF's compensation was via tiered running royalties of upto 12 percent of Vertex's Net Sales of the drugs.22

CFF started monetizing its royalty rights as soon as Kalydeco® received FDA approval in 2012. It received $150 million from an agreement signed in May 2012 and a further $250 million from an agreement signed in May 2013, both with undisclosed purchasers.23 In November 2014, CFF announced that it had sold its remaining royalty rights in Vertex's CF treatments to Royalty Pharma for $3.3 billion, the biggest royalty monetization ever.24

In another example, the Japanese trading company Mitsui and the U.S. CRO Quintiles Transnational Corp created two funds, one of $459 million in 2013 and another of $866 million in 2016, to invest in Phase 3 trials for big pharmas.25 The funds are managed by NovaQuest Capital Management LLC, the strategic partnering group of Quintiles.

In 2008, TPG-Axon, a private equity firm which has a strategic partnership with NovaQuest, agreed to invest $325 million in two Phase 3 trials of Eli Lilly's two lead molecules for Alzheimer's Disease; TPG-Axon would have received success-based milestones and royalties if the trials had been successful and the compounds had received FDA approval; through its side agreement with TPG-Axon, NovaQuest paid 10 percent of the costs and would have received 10 percent of TPG-Axon's returns.26 Lilly has subsequently announced that the trials had failed in all the categories of Alzheimer's patients in which it was tested.

In 2016, NovaQuest agreed to pay up to $200 million to fund the Phase 3 trials of Pfizer's rivipansel. If the drug is successful, NovaQuest could receive a series of payments totaling as much as $267 million, plus royalties on sales, for the next eight years.27

V. Conclusion

Academic institutions discover significant numbers of new drugs, and license over half to start-up or existing small biotech companies, who are highly likely to sublicense them to large pharmaceutical companies at some point down the road. Very large sums can be involved in these sublicenses, and great attention must be paid to the wording used to define the obligations of the biotech to share these payments with the academic institution in the initial license.

Exemplifications of the types of payments which are to be shared may be helpful to avoid disputes down the road, when large sums of money may be on the table. For instance, rather than defining sublicense income to include "milestone payments," it may help to avoid subsequent disputes to define sublicense income to include "milestone payments, including, but not limited to, payments for the achievement of patent, pre-clinical, clinical, regulatory, sales and any other milestones."

When defining how royalties will be shared, it may be helpful to define royalties as "running royalty payments, irrespective of whether they are based on sales revenues, unit sales or some measure of profits."

That said, the absence of such exemplifications in a license should not, of course, be used as a basis to limit the payments which should be shared.

Available at Social Science Research Network (SSRN):

https://ssrn.com/abstract=3103163