We value your privacy

We use cookies to enhance your browsing experience, serve personalized ads or content, and analyze our traffic. By clicking "Accept All", you consent to our use of cookies.

We use cookies to help you navigate efficiently and perform certain functions. You will find detailed information about all cookies under each consent category below.

The cookies that are categorized as "Necessary" are stored on your browser as they are essential for enabling the basic functionalities of the site. ...

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

No cookies to display.

Functional cookies help perform certain functionalities like sharing the content of the website on social media platforms, collecting feedback, and other third-party features.

No cookies to display.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics such as the number of visitors, bounce rate, traffic source, etc.

No cookies to display.

Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors.

No cookies to display.

Advertisement cookies are used to provide visitors with customized advertisements based on the pages you visited previously and to analyze the effectiveness of the ad campaigns.

No cookies to display.

Qinghong Xu, PhD

Attorney

Lung Tin Intellectual Property Agent Ltd.

Beijing, China

Qinghong Xu, PhD

Attorney

Lung Tin Intellectual Property Agent Ltd.

Beijing, China Patrick Terroir

Attorney at law, Teacher of Innovation Economics

Sciences Po Paris

Paris, France

Patrick Terroir

Attorney at law, Teacher of Innovation Economics

Sciences Po Paris

Paris, FranceWhile acknowledgement of intellectual property rights in China can be traced back as far as the Tang Dynasty (618-907 AD), the first patent- specific law in China was enacted in 1889, towards the end of the Qing Dynasty. Modern Chinese patent law, however, began with the issuance of the Provisional Regulations on the Protection of Invention Rights and Patent Rights in 1950, which provided rewards to inventors but left ownership of intellectual property in the hands of the State. The onset of the Cultural Revolution in the mid-1960s, however, brought an end to even this modest recognition of intellectual property.

China began to revisit intellectual property in the early 1980s, first sending a number of researchers to study patent law and practices in other countries and then in 1984 promulgating the Patent Law of the People’s Republic of China (the “Patent Law”). China subsequently became a member of the Paris Convention for the Protection of Industrial Property (the “Paris Convention”) in 1985. The Patent Law was amended in 1992 and China became a signatory to the Patent Cooperation Treaty (PCT) as of 1994. The Patent Law was amended most recently in 2001 in an effort to bring it in line with the relevant provisions of the WTO Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS).1

Innovation and economy have been the focus of Chinese Government development policy for many years (National People’s Congress—NPC—and the Chinese People’s Political Consultative Conference—CPPCC). In early 2006, China convened a National Science & Technology Summit that issued the outline of “The National Medium-and Long-Term Science Plan 2006– 2020.” NPC and CPPCC have then made the innovation as one of the five key concepts of development for the 2016-2020 fifth-year period.

All along these years China has experienced substantial changes in virtually every aspect of its society and economy. As underlined by Professor Xiaolan Fu in her last study:2 “The National Innovation System (NIS) has experimented a series of reform initiatives driving it from a plan-based system towards a market-based open system of innovation.” Now the main challenge is to “move from imitation to innovation” and to transforming the economy from a manufacturing-based to a knowledge-based economy and to perform the transition from “Made in China” to “Invented in China.”3

• China Handled More Patent Applications for Inventions than any Other Country:4

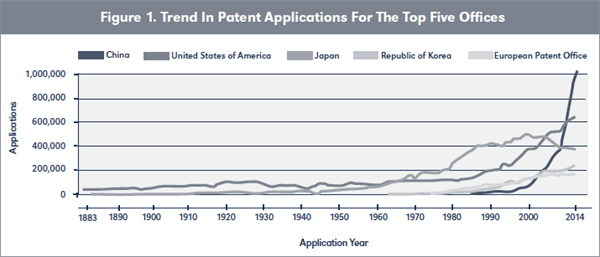

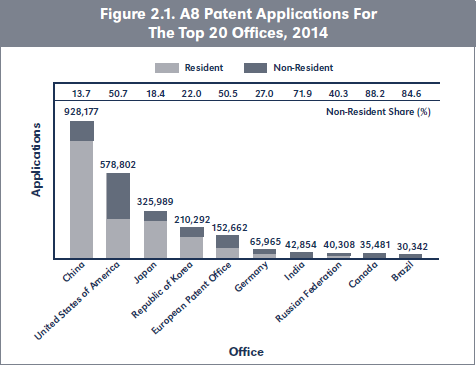

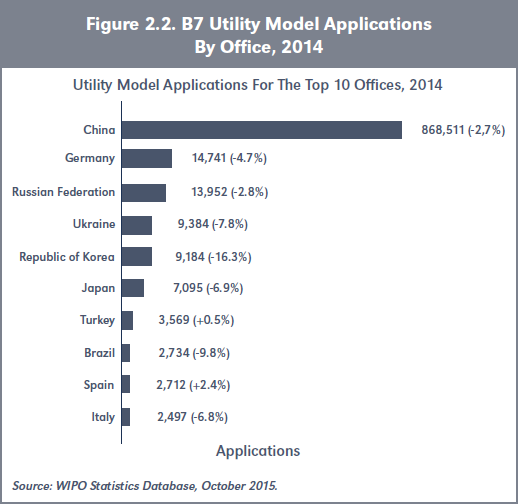

In 2015, the total number of patent and utility models filings reached 2,798,500, among which patent applications for inventions surpassed one million (see Figure 1, 2.1 and 2.2; all figures start on page 147), that is to say more applications than Japan and the U.S. combined.

According to the data released at a press conference from the State Intellectual Property Office (SIPO) of China on January 14, 2016, 1.102 million patent applications for inventions were received in China in 2015, up 18.7 percent from last year, “being the top patent application filer of the world for five years.”

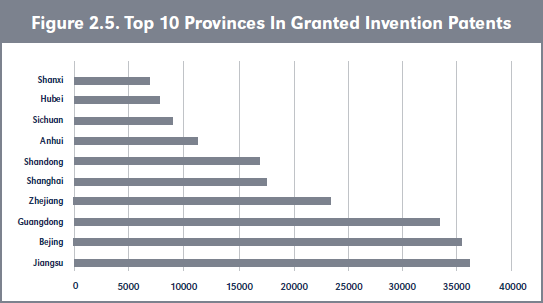

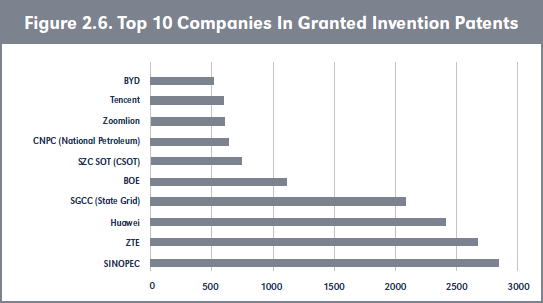

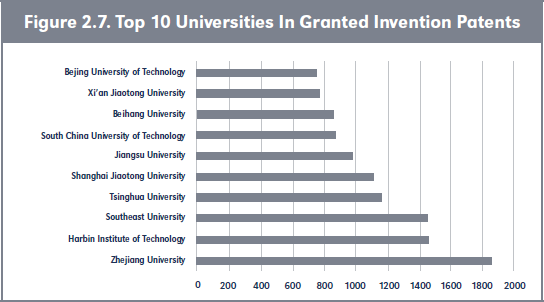

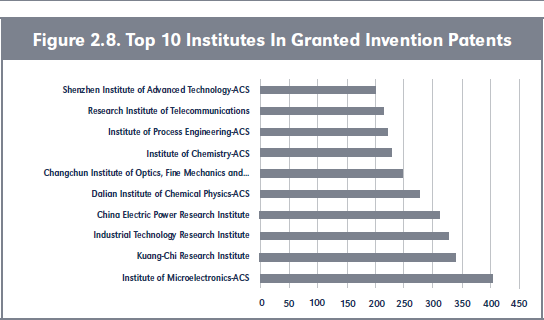

This flow is quite concentrated in three provinces: Jiangsu (36,015), Beijing (35,308) and Guangdong (33,477). (Figure 2.4) China’s top oil-refiner SINOPEC obtained 2,844 invention patents, followed by telecom giants ZTE (2,673) and Huawei (2,413). (Figure 2.5) Chinese Universities are also very active, with the top three being Zhejiang University (1,865), Harbin Institute of Technology (1,454) and Southeast University (1,453). (Figures 2.7 and 2.8).

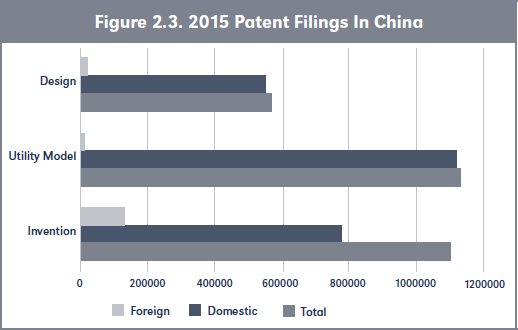

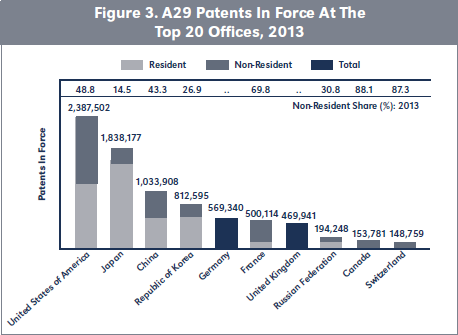

In 2015 about 359,000 invention patents were granted, 263,000 of which were granted to domestic applicants, 100,000 more than in 2014, up 61.9 percent from last year (see Figure 2.3), which placed China in terms of stock of granted patents at the third place behind USA and Japan, with more than 1 million patents in force (see Figure 3).

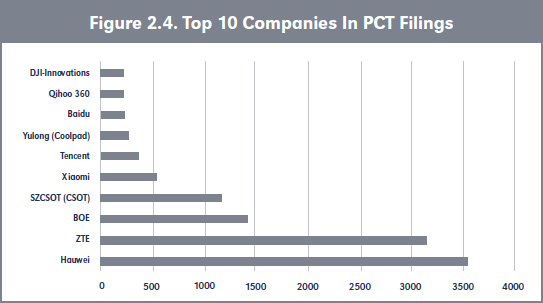

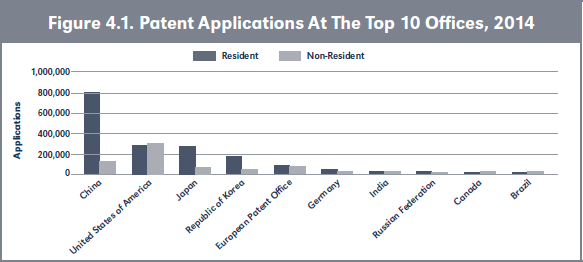

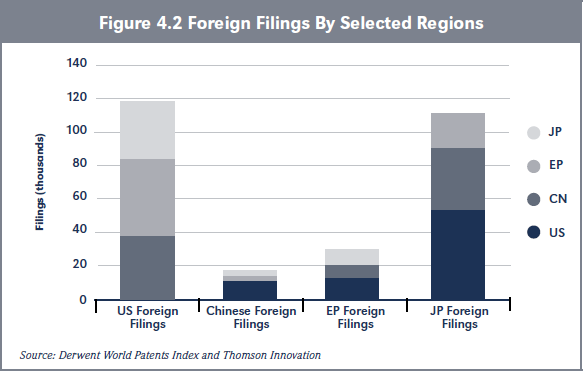

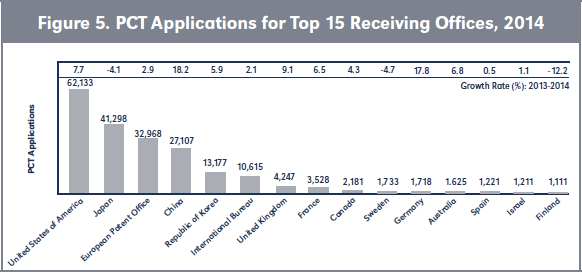

What is very specific of Chinese patent landscape is the small proportion of foreign filings compared to domestic ones, as well as the small proportion of international filing by Chinese organizations as illustrated by the relative small number of PCT filings: 27 000 in 2014 compared to 62 000 for the U.S.A. (Figures 4.1 and 4.2) In 2015, SIPO received 30,548 PCT applications, up 16.7 percent year on year, 28,399 of them were from domestic applicants, up 18.3 percent year on year; 2,149 were international (see Figure 5). China’s top telecommunication giants Huawei and ZTE were the top two filers with 3,538 and 3,150 PCT filed respectively.

• More to Come

If this trend extends over the next coming year (official objective is to reach 14 patents per 10,000 residents by 2020—to compare, California, U.S. State with the highest per capita patent rate, comes closest at 11.4 patents per 10,000 residents), we may expect that China will file in the near future around two million patents a year. As for PCT applications, if China reaches in the future the average relative number of PCT patents than the average OECD countries, it should file more than 100 000 PCT Patents per year.

• The Quality Challenge

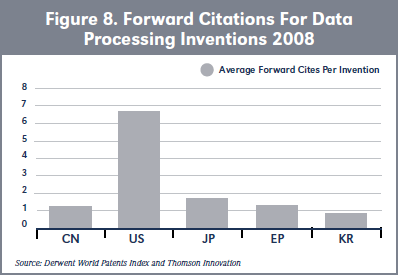

This all-time patent growth record raises the question of the quality of the patent granted—at a time where the flow of patent invalidation of patent has increased since several months in the USA.

On one hand the public policies in favor of patenting have been very pro-active and the volume of patent has been a way to evaluate the innovative performance of the regions. Thus a number of incentives at the territory level or at the industry level have been put in place.

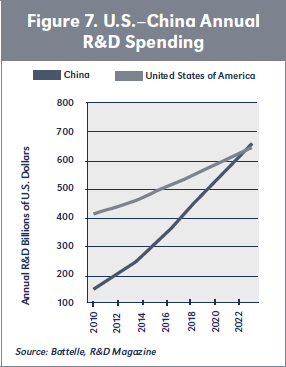

On the other hand, the investment in R&D has been reinforced tremendously. In 2011, China surpassed Japan’s overall spending. By 2018, it is expected to surpass the combined R&D spending of Europe’s 34 countries. And by sometime around 2022, it will likely also exceed the R&D investments of the U.S. in absolute terms (Figure 7).

One of the most salient features of this widespread patent culture is the widespread teaching of intellectual property—even at school, (see Figure 6)—which doesn’t exist in any other country, where IP is taught only to few students at the end of their Masters in law.

This policy of supply and demand has undoubtedly been the source of the surge in patent and utility models over the past years, and it has made patenting a common tool of economy and business—which is not yet the case in developed and in developing countries.

In this context the question of quality of Chinese patent has been contested. The evidence that can be collected on this topic is, unfortunately, very limited, but we would add to the debate the following two remarks:

• A Stronger Enforcement

Many reforms have intended in the last years to increase patent enforcement: besides the creation of IP specialized courts (Beijing, Shanghai, Guangzhou), the new 4th amendment of the Patent Law introduces more precise qualifications for infringement (willful, mass, and repeated), recourse to true technical experts, increase in punitive damages, extension of administrative injunction possibilities, widening of the burden of proof, etc.

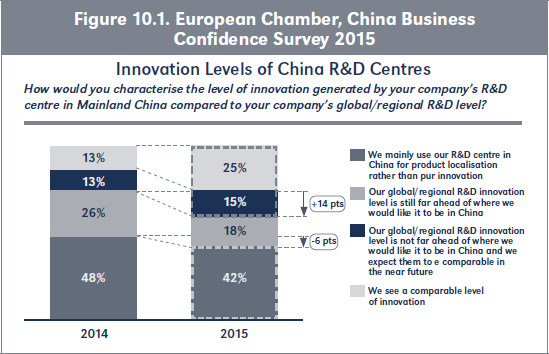

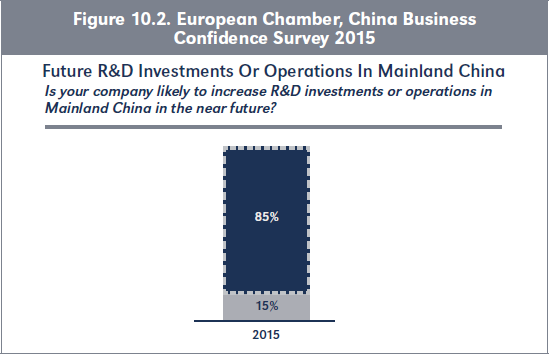

Thus the reliability of the Chinese system is changing: the 2015 China Business Climate Survey conducted by the American Chamber of Commerce in China,6 shows that 86 percent of respondents said that China’s enforcement of intellectual property regulations had improved in the past five years (Figures 10.1 and 10.2), and the European Chamber of Commerce in China stated that 56 percent of its respondents say that enforcement is inadequate but against 95 percent some years ago.7

• China Vows to Speed Up Building an Innovative Economy and an IP Power:

The State Council of China issued an opinion at the end of December 2015,8 which vows to implement national IP strategy, deepen reform in IP key areas, carry out more strong IP protection, promote the development in new technology, new industry and new commercial formats, enhance industrial internationalization development level, and safeguard and encourage mass entrepreneurship and innovation.

China enacted an amendment Law on Promoting the Transformation of Scientific and Technology Achievements (2015 Amendment) at the 16th Session of the Standing Committee of the 12th National People’s Congress on August 29, 2015, which enhanced in its article 1 the transformation of scientific and technological achievements into real productive forces—by motivating inventors and IP creators in institutes or universities to operate transfer, license and by encouraging enterprises in implementing partnership, together with research institutes or universities.

More, the amendment improves the supports for transformation of scientific and technological achievements, such as establishing technology markets, cultivating and developing intermediary service agencies, providing trading places and disseminating technology trading information.

The role of technology and invention transfer in the development of Chinese economy is crucial. From the point of view of western industrial companies this transfer has been considered during the first period as a counterpart to enter the Chinese market. Since some years, this is no more the case as the scientific basis of the country have been soundly strengthened (for example there are now more researchers in China than in the European Union).

As China becomes more and more an innovative economy, “open innovation” concerns more and more industries and universities. The number and impact of different forms of collaboration and exchange are in fact multiplying. While taking its place among global R&D leaders, China recognizes the leverage available through international collaboration. Many of China’s R&D programs involve collaborations with European and/or U.S. research organizations. According to the Battelle/R&D Magazine Global Researcher Survey, about a third of China’s advanced R&D is pursued in collaboration with U.S. research organizations, and about a quarter in collaboration with European research organizations.9

China set up its first technology stock exchange market in Shanghai in 1999. Since then, large-scale technology equity platforms have emerged in Beijing, Chengdu, Shenzhen, Wuhan, Tianjin and Shenyang and accelerated the outbound trade of technological innovation, as well as corporate venturing in commercialising internal new technology, products and large numbers of patents. However, the role that the technology transaction market has played in China’s regional innovation system was not significant over the 1998–2004 period.10

As the improvement of protection of intellectual property rights progress, these exchange and market initiatives ramp up again.

This evolution follows the reflection of OECD when it says, “Facilitating the mobilisation, sharing, or exchange of patents is increasingly important to promote innovation in this globalised and well-networked world, where the circulation of ideas and technologies is essential to innovation. In the context of open innovation, patents are expected to play a role as a means for transferring ideas and technologies from one entity to another”(Guellec, Yanagishawa, OCDE, 2009).

• Chinese Government has Promoted IP Marketplaces for Transformation of Innovations

At the beginning of 2016, the biggest fund of its kind nationwide—a government-led intellectual property fund “Beijing key industry intellectual property fund”—with a total planned capital of 1 billion RMB ($153.3 million) was launched.11 The fund becomes the fourth sovereign fund after IP Bridge (Japan), Intellectual Discovery (South Korea), and France Brevets (France)- but the goals of all these funds are different.

The first phase of 400-million-yuan capital has been sold out focusing on investment in startups and growing companies with high-value patents in mobile internet and biomedicines. The first phase was from the government (RMB 95 million) and investments from industries, IP service agencies, and investment agencies (RMB 305 million). The fund will cooperate with major national IP projects and help IP agencies build multilevel cooperation with investment and financing institutes.

This initiative takes place within the networks of IP marketplaces financially supported by the government. These networks are composed likewise:

We can also put in this category Intellectual Ventures (IV)—China—as long as it doesn’t take a litigious way as it did in western economy.

The 4th amendment in discussion to complete the Patent Law plans to insert a provision on Voluntary license (Articles 82-84), which will try to set up transparency and accessibility in patent licensing, as it reads:

“Patentee can make a statement before the administrative agency under the State Council to express its intention to voluntarily grant a non-exclusive license with a payment of certain amount of royalties Any potential licensee may take the license by notifying the patentee in writing and paying the royalties During the effective period of the voluntary license, the patentee should not grant an exclusive license nor request for preliminary injunction.”

It will be hazardous to predict the success of such a possibility (which exists for example in the UK patent law but has encountered few demands), but it is a strong sign that patents are not only considered as a protection net and a legal redress in China, but also as a technology transfer instrument and a valuation and transaction asset.

As the last report of McKinsey points out14 “China has the potential to build on its strengths in innovation and become a global leader—creating a “China effect” on innovation around the world.

Not only can China serve as the locus of innovation for a growing number of companies that want to penetrate China and other fast-growing emerging markets, but the Chinese approach to innovation also can spread, helping companies everywhere turn ideas into products and services more quickly and for less cost.”

Available at Social Science Research Network (SSRN) http://ssrn.com/abstract=2822298