Dr. Dominique Christ

Dennemeyer Consulting GmbH,

Managing Director,

Munich, Germany

Dr. Dominique Christ

Dennemeyer Consulting GmbH,

Managing Director,

Munich, Germany Niccolò Galli

Max-Planck Institute for Innovation and Competition

PhD Candidate,

Munich, Germany

Niccolò Galli

Max-Planck Institute for Innovation and Competition

PhD Candidate,

Munich, Germany Dr. Cornelia Peuser

Dennemeyer Consulting GmbH,

Consultant,

Munich, Germany

Dr. Cornelia Peuser

Dennemeyer Consulting GmbH,

Consultant,

Munich, GermanyPatent trolls are just a small piece of the patent aggregation puzzle. A myriad of electronics companies, with and without production capabilities, pursues patent aggregation by building patent portfolios and monetising them beyond manufacturing. So far, it is unclear whether such patent aggregation activities have adverse effects on innovation. This article replaces the myopic discussion about patent trolls with a wider picture—that of patent aggregation. It analyses the rationales and evolution of this phenomenon, orders the domain of patent aggregators, and presents the effects patent aggregation activities can have on technological development. Only the interplay of patent and competition laws is considered apt to reconcile patent aggregation with innovation.

Low manufacturing costs of today's global electronics product markets drive price competition to almost perfection.1 Competition shifts on quality and innovation bringing Intellectual Property, particularly patents, onto centre stage. However, quality and innovation depend on costly trial-and-error research and development investments, whose returns can hardly be achieved through direct sales of patent implementing products alone.2 Here patent aggregation comes into play as an alternative path to raise revenue and finance further R&D. Many electronics firms, such as Qualcomm or Huawei, couple end-product sales with patent aggregation practices such as patent licensing and selling (so-called practising entities PEs).3 Other firms, such as France Brevets or Sisvel, completely forego manufacturing and specialise in patent aggregation activities (so-called non-practising entities NPEs). As a natural consequence of the property nature of patents, both PEs and NPEs can enforce their patents against infringers. Whether patent aggregation equates with anti-innovative patent trolls cannot be a summary judgment dependent on the vertical integration of the patentee under scrutiny.4 Rather, it is a factual case-by-case assessment of the effects on innovation of the specific patent aggregation activity considered. EU competition law warrants such an approach, which ensures a positive relationship between innovation and competition law. In light of technological development, patent aggregation activities can either be proscribed as anti-competitive or justified even if otherwise anti-competitive. The remainder of this article impartially analyses the rationales, evolution, and multifaceted impact on innovation of patent aggregation. It concludes that only the interplay of patent and competition laws reconciles patent aggregation activities with technological development concerns.

Patents are one of the public mechanisms to incentivise innovation. Together with direct public research, public procurement, subsidies, and prizes, patents remedy the public goods pitfalls of inventions favouring their disclosure. Once an inventor reveals an unpatented invention, he can hardly prevent others from using it (i.e., non-excludability), also because a single use does not preclude (i.e., non-rivalry) or diminish subsequent ones (i.e., joint-consumability). Without patents, society would experience fewer inventions or, at best, inventions only in limited fields. On the one hand, rational inventors would not undertake R&D investments, lacking the prospect of being able to appropriate their results.5 On the other hand, they would focus on those technological areas where appropriation can be achieved without patents yet otherwise, such as through lead-time, sophisticated product design or secrecy.6 In contrast, the patent right to exclude anyone from practising one's invention, enforceable in courts through property and liability remedies, enables patentees to disclose their inventions while inhibiting free riding.7 Hence, during the years of patent protection, patentees can profitably commercialise their inventions, recover R&D costs, and devote rents to new inventions.8 Accordingly, patents incentivise both inventive activity and the disclosure of its results, while maintaining up-front technological neutrality for R&D investments. Moreover, the public grant of patent exclusivity to inventors is not cheap, as there is no such thing as a free lunch. Patentability, disclosure, and maintenance fee requirements raise the bar for inventors and limit patent rights for the essential benefit of society. In addition to the aforementioned right to exclude, patents also confer the often neglected right to include. In fact, patent rights are as transferable as any other property right.9 This transferability permits inventors to share their knowledge while obtaining remuneration for it. In so doing, patentees can specialise in inventing and outsource the risks of making the invention into a final product.10 Because of patents, each industry player can do what he does best: inventors invent, intermediaries intermediate, and implementers implement.11 Insofar as patent aggregation activities involve knowledge transfer, collaboration, and the division of innovative labour, it is wrong to associate them with patent trolls.

Patent aggregation is commonly conceived as the monetisation of patents beyond the sale of patent-implementing products.12 Despite being not very informative, such conception has the merit of tracing back some long-lasting forms of patent aggregation. In this sense, the pooling of technologically-related patents from different owners into a single licensing program dates back to the mid-XIX century. The Sewing Machine Combination of 1856, the Motion Picture Patents Company of 1908, and the Manufacturers Airplane Association of 1917 are all examples of patent pools created to license technologies owned by multiple parties as a single package obviating anti-commons and double-marginalisation issues.13 Next to patent pools, cross-licenses, whereby two parties grant each other access to the respective patent portfolios, have been a feature of all cumulative technologies industries for decades.14 However, modern patent aggregation practices started with the rise of open innovation business models. Facing the globalisation of production chains and distribution channels, companies like IBM, Xerox, and Texas Instruments began by the late 1980s to heavily license their technologies across entire industries including to the competition. Nor did they hesitate to recur to patent infringement litigation against reluctant licensees.15 Intermingling collaboration and rent-seeking motivations, these patent aggregation pioneers achieved memorable royalty earnings, which showed the immense value lying behind dormant patent portfolios. Since then, very few companies let their patents sit without providing direct monetary value.16 The patent licensing potential attracted the entrepreneurship of a new genre of firms, so-called NPEs, exclusively operating upstream in the technology supply chain as providers of patented technology or freedom-to-operate services.

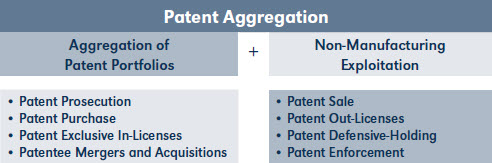

Considering the contemporary patent monetisation practices of both PEs and NPEs, patent aggregation more precisely comprises any activity where patents are aggregated through direct prosecution or transfer and are then exploited for non-manufacturing purposes. Apart from patents, patent applications, patent commercialisation rights or even utility models can be similarly the object of aggregation activities. Ownership or control of the patents is equivalent insofar as the patent aggregating company decides the access terms to the patents.17 Following such a definition, patent aggregation conducts identify two subsequent stages. The first stage involves building patent portfolios, namely sets of related patents with a common function. While patent prosecution unequivocally identifies the filing of patent applications, a transfer is manifold. Indeed, the ownership or control of patents can be transferred either directly through patent purchases and exclusive long-lasting licenses with sub-licensing rights, or indirectly by merging with or acquiring patent owners.18 Electrical engineering firms venture all patent portfolio-building paths. For example, electrical engineering is, according to data from the EPO Annual Reports, the technological field with most European Patent applications—at least since 2001—and with most grants since 2017. Likewise, patent transfers have increased in Europe since the 1990s, with electrical engineering patent transactions involving more patents on average per transaction than any other sectors.19 Last, patent portfolio transfers often drive mergers and acquisitions of electronics firms, such as between Nokia and Alcatel-Lucent or Google and Motorola Mobility.20

No a priori difference exists between a homegrown portfolio or an externally-developed one, since both confer the same strategic benefits and can be exploited beyond manufacturing. After all, what difference does it make for the law if a PE—take IBM for example—directly makes money out of its homegrown patents or an NPE—say Sisvel—does the same with somebody else's patents? From an EU competition law perspective, probably none since both PEs and NPEs can raise collusion, exclusion or exploitation issues. Indeed, any patent portfolio multiplies rather than sums the strategic effects conferred by its individual patents for the better or worse of innovation, thus exacerbating all competition law concerns over individual patent exercises. While a patent gives the rights to exclude and include anyone over the protected claims, a patent portfolio gives such rights over a much broader scope of subject matter. In doing so, patent portfolios confer market foreclosure power, and their magnitude attracts external innovation, shields from litigation, diversifies risks and hedges against uncertainties. It also improves bargaining positions, enhances freedom-to-operate by counter-infringement threats, increases the patentee's weight over patent politics, and allows to attract and retain investments.21

The second stage of patent aggregation starts after a patent portfolio is built. Patentees have four non-manufacturing exploitation options, namely out-licensing, selling, enforcing or defensive-holding. First, patentees such as the above-mentioned Huawei or Sisvel, out-license their patents to third parties, either out-sourcing the implementation of their inventions or expanding it to new markets and applications. Second, patentees sell their patents. However, while the financial parameters of licenses allocate innovation risks between licensor and licensee, the one-off nature of patent sales determines an all-or-nothing approach to the allocation of innovation risks between licensor and licensee. Because of the possibility of over- or underpayment, patent sales usually involve technologies out of the core business of a patentee, see Google's 2018 battery patents sale to Amperex Technology or Intel's 2019 cellular wireless connectivity patents sale to Apple.22 Alternatively, patent sales contribute value to restructuring proceedings, as it happened for Nortel, Kodak or Qimonda.23 The third non-manufacturing exploitation option is to enforce patents, which is especially lucrative for electrical engineering technologies. In fact, the incremental, convergent, interoperability-driven, and fast-pace characteristics of electrical engineering technologies determine a high likelihood of patent infringement in today's global electronics product markets.24 Because patentees are entitled against infringing products to injunctions stopping entire production lines, enforcement quickly leads alleged infringers to settle and accept licenses. Indeed, patent enforcement rarely ends in litigation, which has uncertain outcomes but certain length and costs. For example, Lemley, Richardson and Oliver recently estimate that less than one-third of patent infringement assertions result in litigation in the U.S.25 To counter the spread of nuisance or litigation-cost-based patent enforcement, defensive-holding emerged as the last non-manufacturing patent exploitation option. While PEs have always held their portfolios to shield-off infringement litigation through the threat of counter-suit in mutually-assured-destruction (MAD) settings, a few NPEs started by the mid-2000s to build patent portfolios upon which they offer freedom-to-operate as a service to their clients. Nowadays, diversified business models pursue patent aggregation practices.

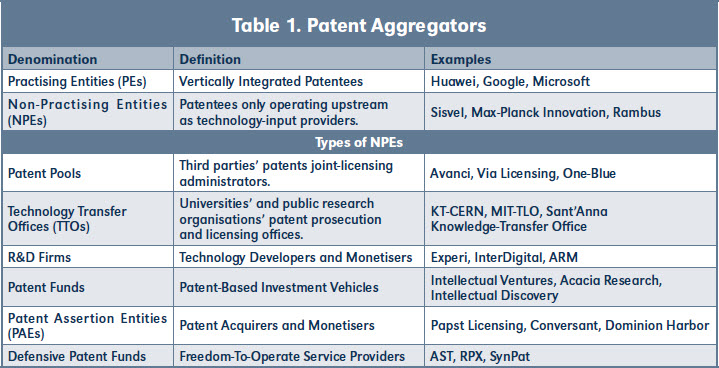

A patentee's position in the supply chain materially affects his options as to how to build and exploit a patent portfolio. Accordingly, the primary distinction of patent aggregators is between PEs and NPEs. PEs are vertically integrated patentees, which operate on both the upstream technology market and the downstream product market. Having both proprietary technologies and manufacturing operations, PEs at times out-license, in-license or even cross-license patents to avoid infringement litigation. Instead, NPEs only operate upstream in the market for patented technology. Without production capabilities, NPEs are not vulnerable to counter-suit nor do they have reputation concerns vis-à-vis consumers. Business model considerations distinguish six main types of NPEs, namely patent pools, technology-transfer offices (TTOs), R&D firms, patent funds, patent assertion entities (PAEs), and defensive patent funds. Patent pools, TTOs, and R&D firms are the more straightforward types of NPEs for innovation. They build their patent portfolios to reach profitable licensing contracts with manufacturers in support of the latter's commercialisation activities. Instead, the remaining NPE types are more controversial since their activities usually omit technology transfer and are so remote from invention implementation efforts.

The classification of patent aggregators informs the analysis of the effects of patent aggregation on innovation. It has the benefits of improving the understanding of the markets where patent aggregators operate, identifying who their clients, suppliers, partners, and competitors are. However, it cannot be rigidly applied since patent aggregators may engage in many patent aggregation conducts over or at the same time. The discussion must objectively focus on the specific activity pursued by the patent aggregator, which impacts innovation, and not on (to some extent) arbitrary entity labels.

The classification of patent aggregators informs the analysis of the effects of patent aggregation on innovation. It has the benefits of improving the understanding of the markets where patent aggregators operate, identifying who their clients, suppliers, partners, and competitors are. However, it cannot be rigidly applied since patent aggregators may engage in many patent aggregation conducts over or at the same time. The discussion must objectively focus on the specific activity pursued by the patent aggregator, which impacts innovation, and not on (to some extent) arbitrary entity labels.The relationship between patent aggregation and innovation depends above all, on what we mean by innovation. Defining innovation as the exploitation of new markets or as new ways of doing business, patent aggregation is in itself an innovation. On the one hand, patent aggregation involves the exploitation of patent portfolios into both totally new markets, such as the market for freedom-to-operate services, and previously under-exploited ones, such as cross-industry technology markets. On the other hand, patent aggregation represents a new way of managing patents that enables companies unlock their idle value. In this regard, the stigma against the first companies that started patent aggregation practices can be explained by their role as mavericks disrupting traditional industry practices.

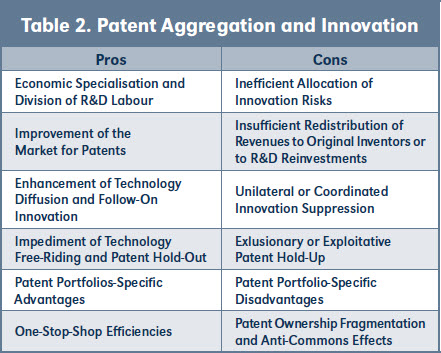

More profound is the effect of patent aggregation on innovation when it is understood as the dynamic process of bringing new products or processes to markets. Each patent aggregation activity presents pros for innovation that can be offset by corresponding cons. See Table 2. First, patent aggregation activities allow for economic specialisation and division of R&D labour.34 Yet, they might entail an inefficient allocation of innovation risks, whereby patent aggregators profit from patented inventions at the expense of those who put such inventions into practice. While prosecuting patents to license or sell them renders economic specialisation and division of innovative labour benefits, prosecuting in order to enforce or hold pre-empts the implementation of patents into products against innovation. Second, patent aggregation practices ameliorate the market for patents.35 However, rents from patent aggregation activities might as well be insufficiently redistributed to original inventors or reinvested into R&D. Any non-manufacturing exploitation of externally developed patent portfolios poses such opposing effects. Third, certain patent aggregation activities accelerate technology diffusion and enhance follow-on innovation, whereas others lead to either unilateral or coordinated innovation suppression. Therefore, the enforcement or holding of patents without implementing them into products undermines innovation more than their licensing or sale, all else being equal. Fourth, patent aggregation that fights technology free-riding (so-called patent hold-out) is often borderline with opportunistic, exclusionary or exploitative patent hold-up, namely outright foreclosure or excessive rent extraction from alleged infringers corresponding to nuisance or litigation costs rather than technological value. Patent hold-up is more likely if the patent licensing or enforcement presents opportunistic features, such as occurring in parallel with industry fairs, consumers shows, and initial public offers, involving soon-to-be-expired patents or targeting the retail and user levels rather than the manufacturing one. Fifth, all patent portfolio-specific advantages for innovation have downsides. For example, portfolio licensing, whereby patents are licensed as a bundle, shortens negotiation times, minimises transaction costs, avoids litigation, provides freedom to operate, certainty and predictability to parties. However, it might also shield weak patents from invalidation, anti-competitively tie unnecessary patents, and overburden the licensee. Last, one-stop-shop efficient patent aggregation activities, solving double marginalisation and royalty-stacking issues contrast with fragmentary and anti-commons ones. Of course, out-licensing only complementary patents saves transaction costs.36 More contradictory is the case for sales or enforcement of externally developed patents representing the disintegration of previously united portfolios as it occurs in privateering.

Patent aggregation is a complex phenomenon resulting from low-cost manufacturing competition of global electronics product markets. It comprises all non-manufacturing exploitation of patent portfolios, much more than the few patent hold-up cases that go to press. First, companies build their patent portfolios through patent prosecution, purchases, exclusive in-licenses or patentees M&As. Then, they monetise them through out-licenses, sales, enforcement or defensive holding. PAEs, or patent trolls, are not the only type of entity engaging in patent aggregation activities. In fact, even before PAEs, PEs like IBM, Xerox or Texas Instruments, brought patent aggregation under contemporary limelight. These are the pioneers that realised that product sales alone could not sustain the R&D investments required to innovate and that thus recurred to patent aggregation. Moreover, next to PAEs there are other types of NPEs that aggregate patents. These are patent pools, TTOs, R&D firms, patent funds, and defensive patent funds. Limiting the discussion to opportunistic patent litigation and PAEs misses the bigger picture of patent aggregation. Rather the focus must be on concrete patent aggregation instances and their double-edged innovation effects. The same patent aggregation activity can spur innovation in one case and stifle it in others. Like Batman, patent aggregation is a hero innovation deserves but not always the right one.37 Even if patent aggregation is in certain circumstances anti-innovative, abolishing the patent system is a reckless option because society needs inventors who, in turn, need patents. A flexible legal framework is needed, accommodating pro-innovative patent aggregation practices while proscribing anti-innovative ones. Upfront, patent law must ensure the grant of only unquestionably valid patents, discourage excessive patenting by, for example, setting prosecution fees proportional to the applicants' patent portfolio sizes, and improve the effectiveness of failure-to-work compulsory licensing schemes.38 Thereafter, competition law must provide legal certainty with clear guidelines on patent aggregation activities, prioritise enforcement against anti-innovative patent aggregation cases, and give more space to patent portfolio analysis within merger control.39 Only the interplay of the patent and competition law domains ensures a positive relationship between patent aggregation and innovation. ■

Available at Social Science Research Network (SSRN):

https://ssrn.com/abstract=3470170

1. In this sense, see Peter Pawlicki, "Re-Focusing and Re-Shifting—the Constant Restructuring of Global Production Networks in the Electronics Industry," in Flexible Workforces and Low Profit Margins: Electronics Assembly Between Europe and China, eds. Jan Drahokoupil, Rutvica Andrijasevic and Devi Sacchetto (Brussels, ETUI, 2016), 23-27; Gerald Sobel, "Importance of Protecting Innovation," les Nouvelles, September 1987:93.

2. On the importance of earnings driven by intangible assets, see Feng Gu and Baruch Lev, 'Intangible Assets: Measurement, Drivers, and Usefulness' in Managing Knowledge Assets and Business Value Creation in Organizations: Measures and Dynamics, ed. Giovanni Schiuma (IGI Global, 2011).

3. Qualcomm's annual revenue from its licensing operations amounts to U.S. $5,163 million in 2018, U.S. $6,445 million in 2017, and U.S. $7,664 million in 2016. See "2018 Annual Report SEC Form 10-K," Qualcomm Inc., accessed July 31, 2019, https://investor.qualcomm.com/annual-reports. For Huawei, out-licensing has brought more than U.S. $1.400 million since 2015, while in-licensing costs more than U.S. $6,000 million since its first license agreement in 2001. See "White Paper on Innovation and Intellectual Property: Respecting and Protecting Intellectual Property: The Foundation of Innovation" Huawei (June 27, 2019), accessed July 31, 2019, https://www.huawei. com/en/industry-insights/innovation/huawei-white-paper-on-innovation-and-intellectual-property.

4. See Raymond Niro, "Maybe Patent Trolls Aren't So Evil After All," les Nouvelles, March 2015:36, 36-37.239

5. See Kenneth Arrow, "Economic Welfare and the Allocation of Resources of Invention," in The Rate and the Direction of Inventive Activity: Economic and Social Factors (NBER, 1962), 614-619.

6. See Wesley Cohen, Richard Nelson and John Walsh, "Protecting Their Intellectual Assets: Appropriability Conditions and Why US Manufacturing Firms Patent (Or Not)," NBER Working Paper no. 7552 (2000), 8-10.

7. In patent law, the main property remedy is injunctions banning infringing products from markets, while the main liability remedy is damage awards compensating the patentee for the infringement. On the appropriateness of liability and property rules to remedy patent infringement, see Carl Shapiro, "Property Rules vs. Liability Rules for Patent Infringement," University of California Berkeley Working Paper (2017).

8. See Roberto Dini, "Fostering Innovation By Way Of Protecting Inventions: The Inventive Loop," les Nouvelles, September 2018:265, 267-268.

9. Article 28(2) of the Agreement on Trade-Related Aspects of Intellectual Property Rights internationally recognizes patentees' rights to license or transfer, inter vivos or mortis causa, their patents.

10. In this sense, see Patent Informatics Team, Patent Thickets: An Overview (UKIPO Report, 2011), 17-18.

11. See Edmund Phelps and Eskil Ullbrg, "The Need for a Global Patent Market," Center on Capitalism and Society Columbia University Working Paper no. 111 (April 29, 2019).

12. Generally, on patent aggregation see Paola Giuri and others, Report of the Expert Group on Patent Aggregation (European Commission, 2015); EPO Economic and Scientific Advisory Board, Patent Aggregation and Its Impact on Competition and Innovation Policy (EPO Workshop Report, 2014); Frauke Rüther, "Patent Aggregating Companies: Their Strategies, Activities, and Options for Producing Companies" (PhD diss., University of St.Gallen, 2012).

13. See Monica Armillotta, Technology Pooling Licensing Agreements: Promoting Patent Access Through Collaborative IP Mechanisms (Nomos, 2010), 57-72.

14. See Christopher Taylor and Aubrey Silberston, The Economic Impact of the Patent System: a Study of the British Experience, (Cambridge University Press, 1973), 292-294; Peter Grindley and David Teece, "Managing Intellectual Capital: Licensing and Cross-Licensing in Semiconductors and Electronics" California Management Review 39 (1997): 8-10; Carl Shapiro, "Navigating the Patent Thicket: Cross Licenses, Patent Pools and Standard Setting" in Innovation Policy and the Economy, eds. Adam Jaffe, Scott Stern and Josh Lerner (MIT Press, 2001), 129-133.240

15. See Rosemarie Ziedonis, "Patent Litigation in the U.S. Semiconductor Industry," in Patents in the Knowledge-Based Economy, eds., Wesley Cohen and Stephen Merrill (Washington D.C.: National Research Council, 2003), 180-210; Robert Bramson, "Mining the Patent Portfolio for Licensing Opportunities and Revenues," les Nouvelles, September 2000:109, 110-111.

16. For practical corporate experiences, respectively of Hewlett-Packard and NEC, see Steven Fox, "How to Get The Patents Others Want," les Nouvelles (March 1999):3; Botaro Hirosaki, "Intellectual Asset Strategy at NEC," les Nouvelles, June 2006:109.

17. Pure patent intermediaries such as brokers do not aggregate patents since they do not take patent ownership or control risks; see Nicole Ziegler, Martin Bader and Frauke Rüther, Handbook: External Patent Exploitation (St. Gallen University, 2013), 13.

18. See EPO Economic and Scientific Advisory Board, "Patent Aggregation and Its Impact on Competition and Innovation Policy," (EPO Workshop Report, 2014), 7.

19. In Ménière et al., transfers increased every year of about 16.6%, being just 1050 in 1997 while 6650 in 2009; see Yann Méniére, Antoine Dechezlpretre and Henry Delcamp, "Le Marché des Brevets Francais: Une Analyse Quantitative des Cessions à Partir des Inscriptions Dans le Registre National et le Registre Européen des Brevets," (INPI Report, 2012), 6-9, 20- 23 and 36. See Fabian Gässler, "Enforcing and Trading Patents," (Springer, 2016), 108 and 125.

20. See Commission Decision of 24 July 2015, Case COMP/M.7632 Nokia/Alcatel Lucent OJ/2015/C329/1; Commission Decision of 13 February 2012, Case COMP/M.6381 Google/Motorola Mobility OJ/2012/C75/1.

21. See Gideon Parchomovsky and Ralph Polk Wagner, "Patent Portfolios," University of Pennsylvania Law Review 154 (2005):1, 31-42.241

22. See Steve Brachmann, "Google Uses the Brokered Patent Market for the First Time to Sell Lithium-Ion Battery Patents," IPWatchdog, September 7, 2018, accessed July 18, 2019, https://www.ipwatchdog.com/2018/09/07/google-brokered-patent-market-lithium-ion-battery-patents/id=100868/; See Apple, "Apple To Acquire The Majority of Intel's Smartphone Modem Business," Press Release, July 25, 2019, accessed July 31, 2019, https://www.apple.com/newsroom/2019/07/apple-to-acquire-the-majority-of-intels-smartphone-modem-business/.

23. See Nader Mousavi and Andrew Dietderich, "IP Deals Meet Bankruptcy: What Every IP Professional Need to Know," Intellectual Asset Management Magazine, May/June 2014:69.

24. Incrementality means that one product builds upon many components. For example, smartphones implement multiple technologies such as touchscreen, GPS, antennas, video-compression ones. Convergence means that many different products use the same component. In this regard, with the advent of the so-called Internet of Things (IoT), every product embeds data-processing and telecommunication capabilities, once upon a time exclusively implemented in computers and mobile phones, respectively. Interoperability, which rests on industry standards, means that different products can interoperate. Last, electrical engineering innovation is also fast-paced since technology life-cycles become shorter.

25. See Mark Lemley, Kent Richardson and Erik Oliver, "The Patent Enforcement Iceberg," Texas Law Review 97 (2019):801, 806.

26. To a lesser extent, patent pools also respond to humanitarian and access to medicine concerns. See Don Drinkwater, "Patent Pools: A Solution For The Telecommunications Industry," les Nouvelles, December 2004:183.

27. See Ron Laurie and Raymond Millien, "Meet the Middlemen," (2008) 28 Intellectual Asset Management 53, 57; Gil Granot-Mayer, Katharine Ku and Laurent Miéville, "Licensing Invention Patents: The Challenge Of TTOs," les Nouvelles, June 2019:94.

28. See Andrei Hagiu and David Yoffie, "The New Patent Intermediaries: Platforms, Defensive Aggregators, and Super-Aggregators," Journal of Economic Perspectives 27 (2013):45, 50.

29. See Expert Group on IPR Valorisation, Options For An EU Instrument For Patent Valorization, (European Union, 2012), 38-44.

30. See Philip Sperber, "Strategic Approach to Licensing Infringers," les Nouvelles, June 1989:63; On the origin of the term 'patent troll' see Brenda Sandburg, "You May Not Have a Choice. Trolling for Dollars," The Recorder, July 30, 2001.

31. See John Golden, "Patent Privateers: Enforcement's Historical Surviros,"(2013) 26 Harvard Journal of Law and Technology 545; Ram Menon and Kevin Spivak, "Trends In Mobile And Consumer Electronics," les Nouvelles, December 2013:238, 239.

32. See Bartsch and others, Intellectual Property Services Classification (IPSC) (Fraunhofer IMW, 2016); Anne Kelley, "Practicing in the Patent Marketplace" (2011) 78 University of Chicago Law Review 115, 119-120; Ram Menon and Kevin Spivak, "Trends In Mobile And Consumer Electronics," les Nouvelles, December 2013:238, 239-240.

33. See Daniel Papst, "NPEs and Patent Aggregators—New, Complementary Business Models for Modern IP Markets," les Nouvelles, June 2013:94, 97; Guillaume Ménage and Yann Dietrich, "Do We See The Emergence Of "Patent Left"?" les Nouvelles, March 2010: 42, 43- 44.

34. See Jiaqing "Jack" Lu, "The Economics And Controversies of Nonpracticing Entities (NPEs): How NPEs and Defensive Patent Aggregators Will Change The License Market, Part I," les Nouvelles, March 2012:55, pp. 59-61.

35. Patent aggregation ameliorates the patent market insofar as it injects liquidity into the market, solves information asymmetries, reduces matching costs between inventions and the market, creates a demand and screens for good patents, remunerates inventors, and saves costs through divestitures or economies of scale. See Daniel Papst, "NPEs and Patent Aggregators—New, Complementary Business Models for Modern IP Markets," les Nouvelles, June 2013:94, pp. 94-97; John Johnson, Gregory Leonard, Christine Meyer, and Ken Serwin, "Don't Feed The Trolls?," les Nouvelles, September 2007:487, pp. 488-490.

36. See Roberto Dini, "Fostering Innovation By Way Of Protecting Inventions: The Inventive Loop," les Nouvelles, September 2018:265, pp. 266-267.

37. The reference is to the quote by commissioner James Gordon from the Batman movie The Dark Night. It exactly goes: "Because he's the hero Gotham deserves, but not the one it needs right now. So we'll hunt him. Because he can take it. Because he's not our hero. He's a silent guardian, a watchful protector. A dark knight." See, Christopher Nolan (Director), The Dark Night (Warner Bros. Pictures, 2008).

38. See Gideon Parchomovsky and Ralph Polk Wagner, "Patent Portfolios," University of Pennsylvania Law Review 154 (2005):1, 60-69.

39. See Lanning Bryer and Scott Lebson, "Intellectual Property Assets in Mergers and Acquisitions." les Nouvelles, September 2000:124, pp. 126-127.