Customary and standard licensing jargon and term sheets used by not-for-profit (academic) research institutions23 generally focus on:

- The IP to be licensed, including the extent to which the rights are being granted extend to corresponding foreign counterparts and other extensions (e.g. continuation, continuation- in-part, divisional, and re-issue patents and patent applications);

- Scope of rights being granted (e.g. exclusive worldwide license, field of use, right to sublicense, to make, have made, use, import, sell, and offer for sale licensed products);

- Financial considerations:

- Up-front payment in cash and/or equity;

- License maintenance fees;

- Royalties—running and minimum;

- Sublicense fees and sublicense revenue sharing obligations;

- Milestone payments; and

- Sponsored research funding;24

- Risk management provisions:

- Warranties;

- Indemnification;

- Representations; and

- Insurance obligations;

- Reporting, audit, and information rights:

- Progress reports (including an example of an acceptable report);

- Audit rights and sales records; and

- Royalty reports (including an example of an acceptable report);

- Equity considerations (in licenses to start-ups with equity):

- License initiation equity;

- Representations and warranties;

- Voting and dividends;

- Covenants;

- Piggyback and S-3 registration rights;

- Redemption rights;

- Participation (preemptive) rights;

- Right of first refusal;

- Co-sale right;

- Drag-along right;

- Certification/Articles of Incorporation;

- Other provisions:

- Confidentiality;

- Reservation of rights;

- Due diligence obligations;

- Use of name restrictions;

- License completion timetable; and

- Binding/non-binding nature of the Term Sheet.25

- Vannevar Bush, Science, the Endless Horizon, 1945.

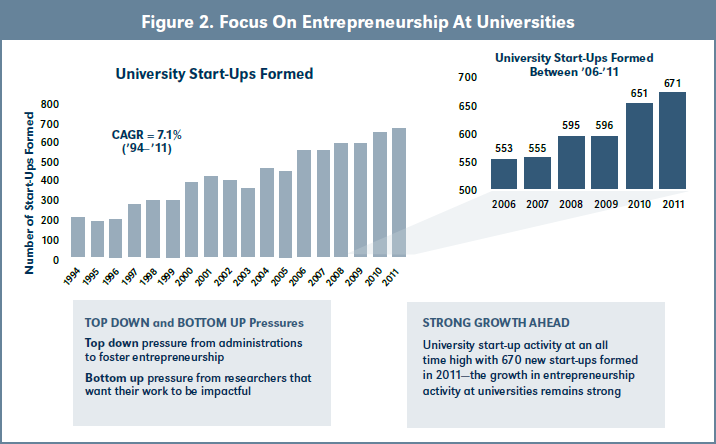

- FY2011 AUTM U.S. Licensing Activity Survey, Table 12: Startups Formed and Primary Place of Business, 2007-2011.

- Ibid.

- New York Academy of Sciences, "Predicting Spinoff Success," http://www.nyas.org/Publications/Detail.aspx?cid=d534df1d-ae31-4bb9-bf27-e51c5c1c4720.

- While industry experienced management is essential for later stage companies seeking financing, discovery stage ventures may be fundable without an investable CEO. VCs, especially those willing to do "complete assembly" start-ups are more likely than not to have relationships with executives who may be "in residence" or otherwise affiliated and are able to serve as interim CEOs. This level of management leadership may be all that is required for early stage technologies funded to establish proof-of- principle and confi m the founding scientifi hypothesis of the venture. Institutions and companies seeking funding are advised to position and title management personnel without requisite CEO level capability as "interim," "general manager," or other designation signaling temporary status.

- In 2013, for example, as a group, VCs are more interested in early stage information technology ("IT") given the capital efficiency and potentially significant valuation step up from seed to Series A. In particular, there are also strong tailwinds (positive investment climate) in 2013 for healthcare IT opportunities. While there appears to be much 'talk' about interest in ag-bio, few venture investments are being made in this sector. Conversely, strong investment headwinds are being felt in capital intensive sectors including clean energy and electronics. Therapeutics, the mainstay of academic discoveries and bio- pharmaceutical company spin-outs, continue to generate interest, despite their capital intensity, especially in oncology and orphan indications.

- Market knowledge and understanding is also what investors want to see and hear from TMs pitching technology transfer deals. In fact, investors often say that this lack of real world relevant industry experience is what they would most want to change in both TLOs and TMs.

- Conversely, investable CEOs do not try to sell a 'field of dreams;' that is, if the company builds it, customers will surely come.

- Thank you to Ken Nisbet, Executive Director of the University of Michigan TLO, for his assistance in crafting this section regarding identifying and recruiting investment CEOs.

- Robert Langer, Nature Biotechnology 31, 487-489 (2013).

- Experience indicates that other than meetings taken as a courtesy, VCs meet with only about 10 percent of pitched deals.

- For a more extensive discussion of term sheets, see Berneman, L.P., Denis, K.A. and Wright, C.F. "Using Term Sheets to Get What You Need and Negotiate for What You Want in Industry-University Licenses," in Association of University Technology Managers Technology Transfer Practice Manual, Marjorie Forster, editor. 2003.

- See Exhibits A and B to compare and contrast a model license term sheet and VC financing term sheet. [ADD: cross reference to NVCA forms on web].

- Golden Rule, of course, also is true for future financings. Anytime a new investor with leverage, enters the picture everything agreed to by previous investors and the company is subject to re-negotiation and change.

- Equity models other than up front exit, including milestone and phantom equity. Though no longer common, historically some institutions deferred taking up front equity positions in favor of being granted equity positions based on the achievement of pre-determined corporate and product development milestones or benchmarks. The equity given at the milestone is based upon the fully diluted share count at the time of the milestone achievement. For example, a university might receive 0.375 percent equity in the company at the time of IND filing and an additional 0.75 percent upon finishing Phase 2 studies. Among the challenges with the milestone equity model for universities is that they only receive equity at predetermined milestone events, which may not be achieved prior to an exit.More common than milestone equity structures, but now also generally out of favor except in "express licenses" and the like, is phantom equity. Clearly, phantom equity is gaining in popularity as express license structures are used. Phantom equity is an arrangement in which the institutional founder does not hold equity in a start-up until the time of the company's sale (exit). In this equity structure, the founder is given an amount of cash equal to a pre-determined percentage of the market value of the enterprise at the time of sale. For example, as part of their "Carolina Express License," the University of North Carolina takes 0.75 percent of the start-up's fair market value at the time of a liquidation event (M&A, IPO, asset sale). The NIH is currently using a similar structure and UCSF used a similar structure in the past. Typical phantom equity is in the range from 0.5-2 percent market capitalization (value) at exit.

- A study by Berneman et. al. at U Penn in 1999 found that across multiple institutions and technology sectors, the average equity percentage holding for institutions at the time of exit was 0.6 percent.

- Readers may wish to view model financing documents from the National Venture Capital Association. See http://www.nvca.org/index.php?option=com_content&view=article&id=108&Itemid=136.

- Model NVCA Term Sheet, March 2011.

- State laws regulating the offering and sale of securities to protect the public from fraud.

- Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time, after the restrictive legend on the back of the security has been removed by a transfer agent. http://www.sec. gov/answers/rule144.htm.

- Absent an exemption, if a pension plan subject to ERISA is a limited partner in a venture fund, then all of the venture fund's assets are subject to regulations that require the venture fund assets to be held in trust, prohibit certain transactions, and place fiduciary duties on fund managers. However, a Venture Capital Operating Company ("VCOC") is not deemed to hold ERISA plan assets. To qualify as a VCOC, a venture fund must have at least 50 percent of its assets invested in venture capital investments. In order to qualify as a venture capital investment, the venture fund must receive certain management rights that give the fund the right to participate substantially in, or substantially influence the conduct of, the management of the portfolio company. In addition to obtaining management rights, the fund is also required to actually exercise its management rights with respect to one or more of its portfolio companies every year. http://www.startupcompanylawyer.com/2007/12/03/what-is-a-management-rights-letter/.

- Investors who are competitors or who have competitive interests may not be afforded such rights to information.

- See Appendix A for a model academic licensing term sheet.

- A number of institutions are increasingly using licenses to start-ups to generate near-term sponsored research support for investigators and value such funding as a productivity metric.

- For a more extensive discussion of term sheets, see Berneman, L.P., Denis, K.A. and Wright, C.F. "Using Term Sheets to Get What You Need and Negotiate for What You Want in Industry-University Licenses," in Association of University Technology Managers Technology Transfer Practice Manual, Marjorie Forster, editor, 2003 and later editions.