les Nouvelles July 2024 Article of the Month:

Thoughts On Developing An AI IP Strategy

Chief Licensing Officer New Segments, Nokia

Sunnyvale, CA, USA

Introduction

AI Has Entered a New Era of Capabilities

While AI has been successful for narrow applications in the past, general reasoning models only reached human-level capabilities within the past couple of years. Due to the creation of large language models and the advancement of computing infrastructure, AI models can solve complex, multi-disciplinary problems at the level of humans,1 a feat which was not possible just a few years ago. In fact, current state-of-the-art models are showing more creativity potential than humans.2 See Figure 1.

This breakthrough in AI capabilities has led to a flood of attention to the AI space. When ChatGPT officially launched at the end of 2022, it reached one million users within five days of launch and crossed 100 million users within two months of launch.4 This kind of growth is unprecedented even when compared to other successful software apps. As a result, AI investment activity has been rapidly growing. In the five-year period from 2017 to the end of 2021, AI investment activity increased by over 500 percent.5

AI is still in the early stages of business adoption, but companies are eager to find ways to use AI in their operations and products. IBM found that 42 percent of IT professionals at large organizations have active AI deployments, and an additional 40 percent of respondents were exploring AI solutions.6 McKinsey found that while 55 percent of surveyed organizations reported having adopted AI in at least one business function, only 16 percent had adopted AI in three or more functions,7 suggesting that AI is still not being deployed expansively even within companies who are using it.

You Need to Have an AI IP Strategy

There is a strong demand to find ways to use AI in businesses, but we are still in the early stages of AI adoption. Companies who can find ways to leverage AI in defensible ways will have a significant edge over their competitors. It is important now more than ever to not only have a business strategy around AI, but an IP strategy that can protect the AI products/services you create.

This article explores the broader AI patenting landscape and key considerations for creating a successful AI IP strategy. It first focuses on the AI technology stack and patenting trends in AI. It then explores four case studies to look at ways AI IP can be leveraged. Lastly, it provides a framework for companies to guide the development of their own, customized AI IP strategies.

AI Technology Stack and Patenting Trends

The AI technology stack spans hardware, software, and applications with significant variation in patentability. See Figure 2.

According to a report prepared by Sherpa Technology Group, the AI/ML technology stack can be broken into three distinct layers: hardware, software/models/platforms, and applications, each requiring its own unique IP strategy.9

For most companies, the application bucket offers the most opportunity for valuable IP creation as 1) patents can be more easily granted, 2) infringement can be more easily proven, and 3) there is significant “whitespace” available, as AI can be used in a wide array of industries. The key challenge for patenting applications is ensuring that your IP covers the critical “chokepoints” required for your specific use case. Given how quickly AI is advancing, a current method could be outdated within a couple of years, so owning fundamental IP is key.

AI hardware offers very strong IP potential, but it can be difficult to own foundational patents if you are not already an AI chip powerhouse like Nvidia or Broadcom. However, since every AI deployment will need to use AI hardware at some point to train the underlying models, owning AI hardware technologies can be incredibly valuable.

The middle layer, which encompasses AI model development, can be difficult to patent. A mathematical model cannot be patented directly, and “AI model training” may be too abstract to get valuable IP coverage over. However, owning patents in this area may not be necessary. As more and more state-of-the art models are becoming easily accessible, the value of AI is shifting to the data used to train the models. While it is easy for anyone to use ChatGPT out of the box, not everyone has the data infrastructure or the expertise to fine-tune an AI model to create an outstanding product for their specific use case. You can protect your advantages here through trade secrets and by building up better internal AI expertise and data management capabilities than your competitors.

AI is Taking an Increasing Share of Patent Filings

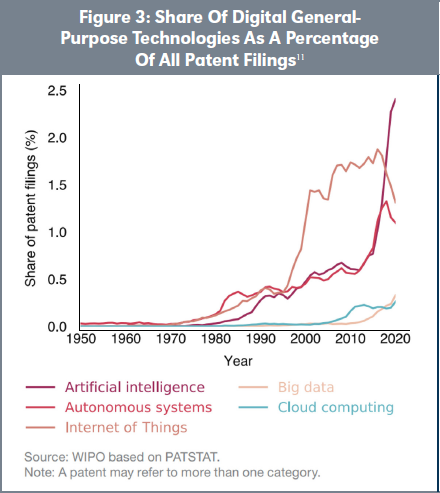

AI patent filings have exploded over the last several years as companies race to claim their share of the AI technology stack. This trend is likely to only accelerate in the coming years as AI technologies become more pervasive and important.

In the World Intellectual Property Report 2022, WIPO estimates that AI patent filings grew 718 percent faster than total patent filing growth during the five-year period from 2016 to 2020.10 Artificial intelligence has also been the fastest digital general-purpose technology, outpacing autonomous systems, IoT, and cloud computing. See Figure 3.

Sherpa Technology Group estimates that nearly 60 percent of all AI patents that have ever been filed have been filed in the past three years. Since 2012, when big data infrastructure started to take off, AI patent filings per year have grown at a CAGR of 33 percent.12 See Figure 4.

Big technology conglomerates are unsurprisingly the top holders of active AI patents. However, there is still a broad mix of industries within the top filers, including consumer electronics, insurance, industrial automation, power grid management, and finance. This dispersion in industries suggests that most of the patenting is in the application bucket of the AI technology stack. See Figure 5.

Chinese patents account for 52 percent of the AI patents in our dataset, so the companies at the top when looking at just U.S. patents are quite different compared to when looking at worldwide patent counts. U.S. patents made up 20 percent of AI worldwide patents. In total, we estimate that there are 960,000 active AI patents worldwide.

AI Business Case Studies

Case Study 1: AI in the iPhone

Apple’s Neural Engine (ANE) was first unveiled in 2017 during the launch of the iPhone X and the A11 bionic chip with Tim Cook claiming it would help “set the path for technology for the next decade.” 14 This statement has held true thus far, given the growing AI features on the iPhone and the focus on improving the neural engine. From the A11 Bionic to the A17 Pro found in the iPhone 15 Pro, ANE’s processing power has increased nearly 60-fold. See Figure 615 on Page 109.

Many of the iPhone’s marketed features are made possible by ANE. For example, Face ID, a signature security feature of the iPhone, was only possible due to the neural engine in the A11 bionic chip.16 ANE also powers key features such as Siri, background blurring in photos, live text translations, battery life optimization, augmented reality features and much more.

Apple has been active in protecting their AI inventions. They have built up an impressive portfolio supporting their neural chip and the various AI functions on the iPhone. Apple’s AI patent filings per year nearly tripled from 2016 to 2018 with ANE being launched in 2017. Filings per year have remained high, as Apple continues to build out its AI hardware and software. See Figure 7 on page 109.

By owning critical technologies in both the AI hardware and application buckets, Apple has managed to stay ahead of its competitors. Despite Face ID being launched over six years ago, there has not been a competitor that has come close to matching Face ID’s speed and security. This is due not only to Apple’s unique ability to control hardware and software on the iPhone, but also its strong IP positioning in AI-powered biometric authentication.17 Other companies have begun following Apple’s lead. Google debuted the Tensor Chip on the Google Pixel 6 in 2021, hoping to marry AI hardware and software like Apple did with ANE.

Case Study 2: Neural-Network-Based Video Coding

Traditional video coding (H.264/5/6) has been very successful with ~50 percent compression improvements with each successive generation. However, AI/ ML is poised to disrupt traditional coding methods, which are getting increasingly difficult to continue improving at previous rates. A neural-network-based video coding standard could be one of the first AI/ML standards to gain mass adoption.

Moving Picture Experts Group (MPEG) has been developing neural-network video coding standards, which have garnered significant momentum from industry participants. Currently, most of the work is under the EE1 standard in the JVET working group. Nokia has been actively contributing to the work of this standard along with other big players in the licensing and consumer electronics space.

While EE1 has shown promise, it still has not been able to dethrone next-generation traditional video coding work. Current work has not been able to match the compression performance of the EE2 standard— MPEG’s next-generation traditional video coding standard (a.k.a. H.267). Moreover, the complexity and computational requirements for current EE1 implementations are too high for practical use. Industry leaders will also need to define neural-network hardware guidelines to allow for a standard like EE1 to be used since neural-network chips on smartphones today do not have open interfaces.

All is not lost for neural-network coding though. Recent work by Microsoft researchers showcased a neural- network video codec that achieved performance on par with next-generation traditional video codecs.18 Moreover, as AI chipsets continue to grow in processing power and the number of devices with these chipsets increase, neural-networking coding will become more feasible to implement.

While a fully end-to-end AI/ML video coding solution is still distant, a hybrid approach where portions of the video coding pipeline implement AI/ML looks promising. Ongoing work in neural-network post filtering has produced great results and is much more feasible to implement. Neural-network post filtering SEI messages were recently added to the MPEG Versatile Supplemental Enhancement Information (VSEI) standard, to which Nokia has been a large contributor.19 See Figure 8.

While AI/ML video coding is still in its early stages, the IP licensing opportunity for a standard based around this technology is significant. Previous MPEG standards like H.264 (AVC) and H.265 (HEVC) are the industry standard for current-gen video encoding. Given how disruptive AI/ML technologies have been in other domains, there is a good chance that neural-network- based video coding is able to outperform traditional coding methods at some point. Morevoer, the patentability is high given the standardized nature of the technology and its more application-focused nature.

Next-generation video coding will be needed to power augmented and virtual reality applications in the future, and AI/ML video coding could be part of that solution. Companies working on the technology today will be well positioned for potentially huge licensing rewards in the future.

Case Study 3: SAP Joule

In September 2023, SAP released Joule, a generative AI assistant that is embedded in SAP’s product suite. Joule was trained on SAP’s vast data pool of 28,000 global SAP customers, including 300 million SAP users, 21 so it can provide very specific answers curated to its customers compared to a more generalized AI like ChatGPT. Joule was developed in partnership with IBM, Microsoft, and Google.

Joule can do context-aware tasks based on the specific account’s data. For example, it can create a job posting based on an existing position and/or employee at your company, or it could answer questions about revenue numbers for a specific product. Joule can also do employee-specific tasks such as aid in optimizing an existing workflow for an individual employee.22

The tight integration with its vast product suite and customized experience gives SAP a data and product moat that protects it from potential copycats. Even if another company wanted to copy Joule, it would not have access to SAP’s data, nor would it be able to leverage SAP’s existing product suite. SAP also likely has some trade secrets around Joule integrations and the training specifications for the model.

While Joule’s value lies within its data and training, SAP’s AI portfolio ensures that it keeps direct, well-resourced competitors from encroaching on its AI innovations. SAP has ~800 active AI patent families, most of which relate to data processing, data privacy, and various machine learning methods for SAP products.23 This portfolio covers much of the application layer and parts of the middle layer in our AI tech stack.

SAP deploys a two-pronged approach to protecting its AI assets across the tech stack. It protects the middle layer of the AI tech stack through its data and product moats and keeps larger competitors at bay with patent protection at the application layer.

Case Study 4: AI Imaging and Diagnostics in Healthcare

AI-based diagnostic tools speed up the interpretation of medical images and improve early detection of diseases. AI-assisted imaging is being explored across radiology, pathology, cardiology, and other medical domains. 24 From skin cancer diagnosis, to detecting retinal disorders, to colorizing grayscale images, AI imaging has immense potential.

In January 2024, the FDA approved DermaSensor, the first AI-powered spectroscopy tool for diagnosing skin cancer. DermaSensor examines lesions at a cellular level and then uses an algorithm to create a diagnosis. DermaSensor demonstrated a 96 percent sensitivity for detecting skin cancer in clinical trials. Moreover, a study with 108 physicians found that DermaSensor decreased the number of missed skin cancer diagnoses by half (18 percent versus 9 percent).25

AI-assisted optical coherence tomography (OCT) has proven to be highly promising, achieving performance better than junior and senior ophthalmologists when detecting 15 retinal disorders.26 AI-assisted OCT on a telemedicine platform achieved a sensitivity of 98.5 percent and specificity of 96.2 percent for detecting both urgent and routine cases.27 AI assistance greatly reduced total human consultation time and allowed for faster treatment of urgent cases on the telemedicine platform.

Colored medical images provide more diagnostic information than grayscale medical images to doctors, leading to more accurate diagnoses. Generative Adversarial Network (GAN) models have shown promise in generating colorized images from grayscale images such as MRI and CT scans, adding valuable visual information that would otherwise not be accessible.28

Medical imaging and AI diagnostics are highly patentable and reside within the application layer of the AI technology stack. While patenting in the domain is highly active, there remains plenty of opportunity to generate valuable IP given the nascent nature of AI imaging technologies.

Developing Your Own AI IP Strategy

This article examined the current state of AI and looked at four different use cases of AI and how IP played a role in each of them. Now it is time to think about how you can develop an effective IP strategy for your AI inventions.

You must first define your objective. If you are looking for a defensive strategy to protect your business, you need to focus on identifying the profit generating product features you are trying to protect. If you are looking to generate IP for licensing, you need to examine others’ R&D roadmaps to see where future value could lie. In either case, you need to have a clear understanding of what specific AI functions you want to build a strong IP position around.

Next, you need to create a technology stack for your specific AI solution. This article presents a high-level AI tech stack, but for a go-to-market IP strategy, you will need to understand the nuances of the specific AI technology you are trying to patent.

Next, find the technology chokepoints within your AI technology stack. A technology chokepoint is a foundational piece that anyone looking to build a product within the domain cannot design around. For example, someone looking to make their own version of Apple’s Face ID will need to create a 3D mapping of the user’s face. The sensors required to capture this mapping could be a potential chokepoint for facial authentication. If you own the technology chokepoints, you not only protect your products, but you also prevent others from building similar ones without infringing on your IP.

Next, identify the available “whitespace.” Determine which chokepoints others have already captured with their IP and where the best opportunities are to generate new, valuable IP. Since AI is a fast-moving space, you must pay special attention to chokepoints that could become obsolete. It is possible that IP coverage that looks good today may not look so good in a few years.

Then, assess what the right IP strategy is for the whitespace you have found. As previously discussed, not every AI function can be patented easily, and oftentimes you can protect yourself though trade secrets or by proprietary data. If you are a licensor, you need to ensure that the whitespaces you have found can be successfully patented.

Lastly, play to your strengths. You need to understand what your own limitations are and where you are most likely to succeed. You should first find the low-hanging fruit that you can easily capture before tackling more ambitious technology areas. Your goal with this exercise is to give yourself the best odds of generating valuable IP. ■

- 2024 AI Index Report.

- The current state of artificial intelligence generative language models is more creative than humans on divergent thinking tasks.

- 2024 AI Index Report.

- https://twitter.com/JohnNosta/status/1625931992620466183.

- 2024 AI Index Report.

- IBM Global AI Adoption Index 2023.

- The state of AI in 2023: Generative AI’s breakout year.

- World Intellectual Property Report 2022.

- The AI patent gold rush — fortunes hinge on IP control.

- World Intellectual Property Report 2022.

- Ibid.

- The AI patent gold rush — fortunes hinge on IP control.

- Ibid.

- https://www.wired.com/story/apples-neural-engine-infuses-the-iphone-with-ai-smarts/.

- https://www.makeuseof.com/what-is-a-neural-enginehow-does-it-work/.

Figure 5: Top 20 Active AI Patent Holders*

- https://support.apple.com/en-us/HT208108.

- https://www.biometricupdate.com/202310/australianfirm-loses-biometrics-patent-infringement-suits-against-apple.

- Deep Contextual Video Compression.

- Efficient Adaptation of Neural Network Filter for Video.

- Ibid.

- https://blog.sap-press.com/what-is-sap-joule.

- https://www.sap.com/products/artificial-intelligence/ai-assistant.html.

- Data sourced from Innography using a variety of AI related search terms and CPC codes.

- How Artificial Intelligence Is Shaping Medical Imaging Technology: A Survey of Innovations and Applications.

- FDA Clearance Granted for First AI-Powered Medical Device to Detect All Three Common Skin Cancers (Melanoma, Basal Cell Carcinoma and Squamous Cell Carcinoma).

- Accuracy and feasibility with AI-assisted OCT in retinal disorder community screening.

- Evaluation of an OCT-AI–Based Telemedicine Platform for Retinal Disease Screening and Referral in a Primary Care Setting.

- Robust Medical Image Colorization with Spatial Mask-Guided Generative Adversarial Network.